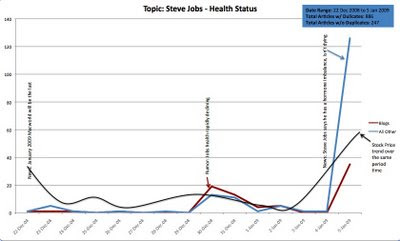

Here’s an interesting chart on the relationship between rumor, blogs, news and the stock price for Apple around Steve Job’s health . The period is Dec 22 thru Jan 5. The red line is blog volume on his ill health, the blue line is formal reported news on his health and the black curve is AAPL stock price.

Initially Apple announced that this would be the last MacWorld and that Steve would not be speaking. The stock dropped. Then Dec 30 the rumors start that Steve’s health is deteriorating. The blogs are ahead of the news and in higher volume than news, and the stock again dips. Then, when the news is official from Apple that Steve has a “hormone imbalance” (sadly no longer the whole story) the official news sites spike up, and blogs have a lower spike.

This is an example of the type of thing we see in FirstRain all the time. Blogs are ahead that something is up. They are often written by specialists with inside visibility into what’s changing – in this case people close to Apple. News follows and the stock moves on news, but that’s the same time everyone else gets the information. Most investors don’t yet have access to tools to help them sort out the junk in the blogosphere and filter for reliable sources. Queue FirstRain.

Here’s another example of management turnover signalling structural changes coming in a company. The WSJ reported on Saturday that Clear Channel, the largest radio and outdoor advertising company in the US, is planning to lay off 7% of its workforce, or 1500 people. It’s behind its competitors in doing a restructuring because of the 18 month battle to take the company private which finally failed in July 2008 – but clearly management knew major layoffs were coming and started leaving.

This chart shows the detectable management departures for just the last 6 months (we pick them up from the web even though they are not announced) and compares Clear Channel with its media competitors.

Satyam’s disastrous news of financial fraud two days ago – which sent the stock plummeting again – could have been seen in advance in the turnover at the top at the end of December. The company had struggled with two acquisitions last year – which we now learn were intended as a last ditch effort to fill the gap – but you can see here in the FirstRain management turnover chart of the last 90 days that 4 board members resigned in December, after very little top level turnover for years.

Board of directors mass turnover only usually happens in a private equity buyout where the board is replaced, otherwise mass turnover is a huge leading indicator that something is very wrong – as was clearly the case at Satyam.