Diversity is a strength – especially in management teams – but it can also lead to tension, misunderstandings and all the challenges that can appear when two people are very different and don’t “get” each other.

Years ago it was popular to hire expensive consultants – often called coaches – to work with executive teams and help them form tight bonds and appreciate one another but having been put through that type of coaching several times in my career at different companies I am now a great believer in the home grown use of personality based team building to develop an appreciation of the differences.

The method I advocate is going through Myers-Briggs Type testing as a team and sharing and talking about the results.

First step is everyone takes the test – online and together in a room – you can take the test here.

Next I explain (in lay terms) what the Myers-Briggs Type Indicators are – what they mean and what they indicate about each personality and how it influences and decision making. I’ll walk through the 4 dimensions and I use simple anecdotes to explain the differences – as I show here. (Each is a scale where you get a percentage along the scale to one end or the other as a measure of your personality type along that dimension.)

Note a healthy dose of humor and self depreciation at this stage breaks the ice and gets the team to relax.

E————-x————I

Extroverted vs. Introverted: what energizes you – being with people or being alone? To make a decision do you go and talk to other people or go for a walk? Are parties exciting or a bit of a chore?

S————-x————N

Sensing vs. Intuiting: Do you gather data and then make a decision – or do you intuitively make a decision and then use data to validate or invalidate your decision?

T————-x————F

Thinking vs. Feeling: Do you decide with your head or with your heart? Where are you in your body as you work through tough decisions.

J————-x————P

Judging vs Perceiving: This is a desire for structure – do you make lists, organize into spreadsheets, like operational process or do you prefer being open ended? Do you take a list to the grocery store or buy as the mood takes you? Do you plan your vacation down to the hour, or get in the car and just drive?

This is a layman’s view – Wikipedia has a much better description here.

And then – it’s time to share. I look for the extroverts in the team to start to talk – to share their type and talk about what it means and how it affects them in the team.

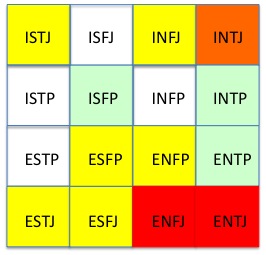

At this point I am at the white board and draw the chart (below) – and start putting names into the boxes so everyone can see where they fit – and how they are like, or unlike other people in the team. It’s really important at this point to make sure everyone understands there is no right or wrong, no one type is any better than any other – and that the strength lies in diversity. It’s much better in a team to have some P some J, some E some I , some N and some S. If you can leverage each other you can quite simply make better decisions because you can cover each others blind spots and biases.

I ran this process with our whole US team a month ago – and then our India management team last week. It was great fun both times. Lots of laughter (led by the Es) and some very insightful discussions about where the tension comes from. For example – a strong J can really annoy a strong P. J’s often state opinion as fact – they are putting structure on the opinion and testing the idea – but for a P this can seem arrogant and over constraining.

So how did my team come out? As you can see from this diagram we have a strong collection of leaders in the ENJ – they are extroverted, very intuitive and operational. Surprisingly this is not at all representative of the population at large. 63% of FR management are NJ, and yet only 7.8% of the population are NJ. So we have a very unusual concentration – and I think this is characteristic of the type of people who enjoy high growth, hurly burly opportunities where they can make decisions fast, based on intuition, and operationalize the execution.

If you are my competitor and you are reading this you may be able to figure out our inherent blind spot… except that I am not an NJ. My personality type is ESFJ. Very strong E (I like people a lot) and am a slight S, but I will challenge intuition by talking with customers and prospects. Knowing I am an ESFJ you can probably understand why I like to talk to customers every single day. That’s both where my energy comes from, and how I gather the input to steer the ship.

The end result of this exercise was very positive, especially within the executive team. We talked through some of the times when we don’t work as well together, and what triggers it – and it is personality related. Just reflecting together and reviewing tough conversations has now been very powerful to defuse the tension the next time it happened. I have the M-B chart on the wall in the office with everyone’s name on it and any of us can refer to it an any time to help understand a team mate – and the only rule is that we all have to remember to use it with a smile – it is just pop psychology after all.

I had the opportunity to speak at the Montgomery Technology conference in Santa Monica yesterday and, as often happens, the experience of presenting FirstRain every half hour for hours was exhilarating.

The conference is run by the specialist investment bank – designed for investors to talk with companies – and it attracted about 1,100 people this year. As a small company the reason to participate is to raise awareness of what we are doing and network with other CEOs, business development people from the Forture 1000 and, of course, talk with potential investors.

Since it is now so easy to quickly show the value of FirstRain I decided not to use any slides but just show it in every meeting. Having a light MacBook Air, wireless and fast fingers I had fun showing the product off in every discussion – in the general coffee area, in a suite, in a meeting room and eventually in my presentation. Now I did use a few slides when I was presenting to the room – but even then just a few and I quickly switched over to the product since seeing is believing with FirstRain.

And the result was a double edged sword. Everyone I spoke to was very impressed – “that’s really impressive” always sounds good to a CEO – and every potential investor I spoke with wanted to understand our stage and whether we were a good fit for them to invest in based on their approach (they were mostly PE or late stage VCs). And I had to disappoint every one. We closed a round of financing 2 weeks ago for $7.2M and so we are not in a position to take additional investment now.

So I took another path to bring them value. Almost everyone I met with is currently a Capital IQ user and so I showed them how to use FirstRain for their research and advised them to just call their Capital IQ sales person and ask for FirstRain through them since they are now one of our reseller partners. It was such fun to be selling, hand-to-hand selling. I love it! And I am glad to say I made a couple of connections with potential partners too.

We’ve been hearing from an increasing number of customers and prospects that they are not only trying to reduce their budget, but specifically trying to reduce their Bloomberg costs or replace Bloomberg altogether and I’m curious as to what’s really going on behind this.

Bloomberg has the premier platform today. It’s known for the deepest quality of data, having the best sales force, being the hardest to use, but also being the hardest to give up. The terminal has cachet. User’s have told us they feel as if their firm thinks less of them if they don’t have a Bloomberg terminal and it’s their link into their IM network. And yet for many of the users in our target market – we’re talking fundamental equity research guys – they only use a fraction of the functionality and in many cases they only use Bloomberg news.

The Bloomberg business model is very simple and consistent with a premier brand. One product, one non-negotiable fee of $1500-$1800 per month and for major accounts services are provided at no additional cost provided the total terminal fees are high enough. And they sell 2 year contracts and won’t cancel them even if the users have left. Makes good business sense.

So what’s a firm to do that has reduced the number of users and wants to dramatically reduce platform costs? What we are seeing is that as firm’s contracts with major high-end (i.e. expensive) vendors are rolling off they are looking at ways to swap the platforms and services out for less expensive ones. This risk/phenomenon is well captured in the Silicon Alley Insider’s The Bloomberg Terminal Stands On The Precipice.

And what it means for FirstRain is we are in an astounding number of conversations now, either alone or with one of our partners, with customers who are looking to replace Bloomberg. Because of the simplicity, and yet rigidity, of the Bloomberg model they are looking to replace it with a less expensive solution, especially when the users are only using it for news, and we help our partners provide a very rich news platform by mining the web for alternative research.

That said, we are careful to be respectful of everyone and not get between two large players because in the end what we offer is different and complimentary to all the platforms today – it’s a sales balancing act!

We are announcing an exciting extension to our Capital IQ partnership today. We started this partnership almost 2 years ago – with this announcement – and over the last two years we have both grown our service to Capital IQ’s end clients and grown our relationship with the excellent team there. My guys really enjoy working with them and we’re delighted they want to include our service in their offering.

And so today we have announced that Capital IQ is now reselling FirstRain to their clients. We have embedded a FirstRain window into the Capital IQ platform that looks like this (with annotations):

and is a very similar integration to the approach we took with FactSet except that in addition to linking through to the search results of the research engine, Capital IQ has chosen to provide quick links directly into key pages like the management turnover page for a company – like this analytic on Pfizer:

This expansion of our relationship is good for both companies. It allows Capital IQ to add the rich experience of business intelligent search into their users research process, and it provides us with access to a new market. Capital IQ is widely used through the banking world, private equity and venture capital, as well as in many small investment firms.

As Randy Winn, executive managing director of Capital IQ said: “Over the past two years we have partnered with FirstRain to bring the most powerful business and financial intelligence to Capital IQ clients. FirstRain’s ability to identify, synthesize and rank critical business information that is scattered across the web provides a competitive advantage to our customers. We are pleased to extend our partnership and to be able to deliver the full range of FirstRain search and analytics to our end users.”