I’ve mentioned before what an exciting time it is to be a part of FirstRain. We’re building momentum every day as our fantastic sales team helps more and more customers in Marketing and Sales roles use FirstRain to monitor and act on the critical events that impact their business, industry and competitors.

But for an increasing number of professionals, the real need is efficiently getting high-quality, Business Web content out to the rest of their organization. This was the challenge we helped solve with Mark Heindselman, Manager Knowledge Network & Info Services at Emerson Process Management. As Mark described,

“We were looking for a better solution to find business relevant content from the web and found FirstRain to be superior to others in this space at delivering highly relevant content. FirstRain allows us to automate the collection of business content and distribute it across the company. We can now put in our users email box or RSS reader the web based news they are looking for and no more. The FirstRain Support team has been very responsive to our requests in setting up and rolling out our service.”

It’s always gratifying when you hear how you’re helping real-world users solve real-world business challenges, and we look forward to solving those challenges for many more!

Notes from a talk I gave at Berkeley Haas School of Business, April 4, 2011

I am going to assume that you know the basics of modeling cash flow. How to build a P&L, read a balance sheet and calculate working capital. Given that, if you are running a small, growing company here are my top 4 tips to manage your cash.

First of all – why is it so important? While VCs may be falling all over themselves today to fund new companies that think they are the next Facebook or Zynga that will not always be the case because good times come and go in the venture community, and it will certainly not be the case if you ever hit a bump in the road.

Part of your job as CEO is to keep the company funded with the capital necessary to run the business and grow – whether it’s your personal cash or from Sand Hill Road. Cash is finite, it’s very expensive in your time to raise (not to mention the dilution to your ownership), and you can’t save your way into growth so you need to make sure you have enough. I see many young companies in Silicon Valley forgetting this today because the money is flowing – but their chances are 1 in 10,000 their company is the next big thing; 80% of them will fail but by being imprudent with their cash they increase the odds that they are on the wrong side of the line.

When I was CEO of Simplex in 2000 cash became a crunch issue for us. We were growing fast, profitable and we needed more working capital to fuel our growth (hire sales people, open international offices etc.) but we could not raise cash from new investors and while our current investors were very supportive they were ready for a liquidity event. The investment community and the bankers were fixated on dot coms – eyeballs and click-throughs (as they are today) – and we were a traditional enterprise B2B software product company. And because the dot com bubble had just burst the public markets were closed to pretty much everyone.

We had no choice but to open a line of credit against our receivables, draw it down and manage every penny. $40M+ in revenue, living off a $4M line of credit until we could raise money in the public markets (which we did in 2001). Combine this with my experience managing FirstRain through the recession and I am a little intense about cash flow.

Tip #1: Build your own model

A good finance team will build you models every day and twice on Sunday but there is no substitute for building you own. Build a P&L, collection and cash flow model yourself. It won’t be perfectly correct because you’ll probably not get all the operating costs right, but by building your own you will have a profound understanding of the underlying assumptions you believe apply to your business.

What is the cost of every engineer? What does health insurance cost really? What is your true collection time? What is the monthly productivity of each sales rep and how many months does it take from hiring to positive cash flow for each rep? What ASP and average transaction size are you assuming – is it realistic? What percentage of your sales reps will fail or turn over – it’s a guarantee some will so how many do you assume? Building your own model will force you through the thinking. Send it to a trusted board member and they will then ask you all the assumptions that you had not thought of and by the time you are done you’ll have a strong gut feel for the cash levers in your business.

Tip #2: Cap your own salary

In most young companies the single highest expense, overshadowing all others, is salary. It’s very tough for any executive to argue that they should make more than the CEO (with the exception of the VP sales when you include his/her variable compensation). So if you cap your own salary below market you can better manage the cash outflow from the salaries of the executive team. This requires that you have enough equity in your option pool to strongly motivate your execs and key engineers (an important part of your negotiation with your investors) – and that you can explain with integrity how the leverage of their options exceeds the leverage of cash you might pull out of the business to pay them more in cash.

It’s a delicate balance because your team needs to make enough to live and not worry about their families, but no more, because in the end they’ll make more money from their options when you reach a successful liquidity event. Basic risk/reward. If someone wants too high a salary – exec or employee – their interests are probably not aligned with your team’s and your investor’s so don’t hire them.

Tip #3: Hire a tight fist in finance

In a small company every dollar counts but you can’t watch every transaction. As CEO, having a persnickety, detail-oriented, negotiating, thick-skinned finance lead at your side is essential. You don’t need a CFO unless you are going public, in fact hiring a CFO too early can hurt you (they tend to need staff), but you do need a controller who can negotiate better pricing with every vendor, manage your DSOs with a strong collections process, push out payables and play chicken with the landlord. Plus the books must be perfect every month, every quarter. You don’t have the time for any mistakes in your accounts.

Tip# 4: Test every decision you make

Every day, for every decision, ask yourself what is the impact on cash flow? For example should you hire more engineers now or 6 months from now, should you hire permanent staff or consultants – how will that change your revenue and collections? Does it drive top line growth? Your engineering team will talk to you in terms of releases and features, you need to translate it in your own mind into sales productivity.

Or when should you hire the next VP? You may be struggling with your own bandwidth but at what point will adding a VP change the revenue growth curve? Or conversely when is waiting hurting the business but you can’t see it because you are buried? Travel policy – everyone in coach of course. Food – build relationships with your local vendors. Office space – go cheap. Interns – yes if you can create a win-win with them. But don’t scrimp on health insurance – personal insecurity kills productivity.

It’s not easy. I have made every mistake there is to make – as you will find most CEOs have if they are honest with you. Growth takes risk, risk means mistakes. And often times I have seen VCs and boards push for growth (and hence cash consumption) too early because they are impatient so you need to keep a clear head on your shoulders. Keep modeling your cash, keep testing every decision against it, and work hard to keep payroll in line and you’ll give yourself the runway you need to prove out your business and give your team the best odds to succeed.

And when the time is right – spend your cash to punch through.

I am excited to announce today that Ryan Warren joined FirstRain as Vice President of Marketing and that Aparna Gupta has been promoted to Managing Director of FirstRain India.

Recruiting an executive with Ryan’s experience, history of success, and track record of innovative thinking in B2B information solutions is another critical step on our exciting growth path. Previously, Ryan led product management at Dow Jones & Co. for the global Factiva information research product line. In his prior 12 years at Dow Jones and Factiva, Ryan held a variety of sales, marketing, product and general management leadership roles. I am delighted that Ryan has joined the FirstRain team. Welcome on board, Ryan!

I’m also happy to report that Aparna is now Managing Director of FirstRain India. Aparna has been instrumental in developing a strong R&D organization in Gurgaon and will continue to make FirstRain India a Central R&D Hub. The success of our solutions is a direct result of our focus on technology and the innovations emerging from our engineering and analytics teams. Aparna has been a key leader in this important transformation across our business. Congratulations Aparna!

To see the full press releases of these announcements, please visit the Press & News section of our website.

Terrific article in TechCrunch last week by Ben Horowitz – What’s the Most Difficult CEO Skill? Managing your own psychology.

Managing inside my own head is by far the most difficult thing I do as a CEO and I appreciate Ben being so out and candid about what’s going on inside. As he says “Over the years, I’ve spoken to hundreds of CEOs all with the same experience. Nonetheless, very few people talk about it, and I have never read anything on the topic. It’s like the fight club of management: The first rule of the CEO psychological meltdown is don’t talk about the psychological meltdown.”

Ben covers classical psychoses like “If I am doing a good job why do I feel so bad?”, and the cliche (and truism) “It’s a Lonely Job” – especially when you are facing a crisis and you have to make the decision to cut staff which impacts the livelihoods of the very people you are working so hard for and care about.

The piece of advice I liked is “Focus on the road not the wall”. It it so easy to stare at all the things that can kill your company – and at any moment in time, even terrific times, any number of things can wipe out a small company. It is this single difference that makes being a CxO in a large company feel so emotionally different than being a CEO of a small company and I have done both. Large companies have mass and momentum – you have time to recover from mistakes most of the time. (A good example is Cadence Design Systems (CDNS) which crashed and fired it’s entire executive team on one day – it’s coming back because of the resiliency of the installed base and the R&D leadership team’s commitment to great products.)

If you have an ambition to be CEO one day read the article very carefully several times.

It was International Women’s Day yesterday and our Gurgaon team celebrated the day by giving roses to each of our female employees in the Gurgaon office and taking them out to lunch. You can see a picture of most of our our female team members below.

FirstRain is an unusual company in that so many of the leadership are women. Myself (CEO), YY (COO) and Aparna (GM India). We all developed our careers based on deep technical training and hard work – there are no quotas in the technology world – and it is both unusual and worth celebrating to have a deeply technical company with almost 50% of the leadership being women (and one woman board member too). It may be indeed be unique, we don’t know. And it is probably a sign that women continue to improve the opportunities they have in our society.

As Aparna (our GM in India) told her team:

“International Women’s Day (8 March) is a global day celebrating the economic, political and social achievements of women past, present and future.

The new millennium has witnessed a significant change and attitudinal shift in both women’s and society’s thoughts about women. We do have female astronauts and prime ministers, more women in the boardrooms, greater equality in legislative rights, and more importantly women’s visibility as impressive role models in every aspect of life. And so the tone and nature of IWD has, for the past few years, moved from being a reminder about the negatives to a celebration of the positives.

2011 is the Global Centenary Year and let’s take this opportunity to celebrate success of all women and especially the India woman Rainmakers.”

A subset of our Gurgaon female team members:

Do you remember those futuristic articles or stories we’d read in the 80s that talked about how with technology we would work less and have more time to recreate? Technology was going to free us from the shackles of our desk. Well, that is possible, if you actually wanted to change it.

The technology of the future has freed us from our desks (mobile phones, laptops, etc.), and this article discusses how the right mix of technology can easily enhance our productivity. Additionally, the Internet has dramatically changed the way that we gather information for business decisions.

With improvements in analytical algorithms in business monitors like FirstRain, Capital IQ, FactSet, and many others, more valuable data can be targeted. The FirstRain platform can filter out the noise, and simultaneously generate highly targeted business intelligence with its patented semantic technology and analytics. Through such advancements, analysts can not only receive information that is personalized and adaptive to their markets, but discover valuable patterns and data trends as well.

In speaking with one of our customers—a sales rep named Samantha Barrett, I was able to understand how she used FirstRain to solve four problems:

This newfound method of information gathering is contradictory to what used to be considered the “traditional” way of researching. Think of it as a new perspective for a new century—it was acceptable, and necessary to “do-it-yourself” given tech limitations in the 90s and first half of the last decade. Searching for your own information was the way to go—who else could you trust to find the most relevant results and cover all the bases? Well, now we can automate it, and we have to start building that trust.

|

The change in information management models to platforms like FirstRain comes as no surprise. Using solutions like FirstRain allows for an easy, efficient way to manage information. Not having to worry about how credible the sources are, or how much time you spend gathering information allocates time for more important tasks.

Being able to understand information in different ways, and having access to meaningful patterns and data trends can directly or indirectly make all the difference in an entire business. Those who embrace the technology will be more effective, and have access to a plethora of information that they otherwise wouldn’t.

The stories of the future are now the stories of the present—the revolution is here and it would be smart to adopt the 21st century trend of “trusting tech,” as the end result will benefit decision makers. No longer can you do-it-yourself, the 80s were right, and once again technology dramatically eases our lives.

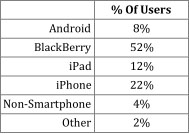

It’s interesting to look at the smartphone choice our users have made across different markets. We conducted a mobile survey a couple of weeks ago and found that a BlackBerry is still a necessity in the corporate environment, but often not enough. However, our survey results are contrary to the latest consumer survey that shows Android surpassing Apple iOS and the Blackberry platform in market share.

While we are developing the FirstRain mobile application, our survey showed that among the users surveyed they have an average of 1.2 devices each – and when we broke it down by device to find that 14% of the BlackBerry users were also using an additional device. We suspect this is because while BlackBerry may be mandated by many firms it simply does not have the app support and so is not as useful and fun outside of the standard corporate apps like email and calendars.

FirstRain Corporate Survey February 2011 |

What does this mean for RIM? Research in Motion first introduced the BlackBerry in 1999, and 12 years ago the BlackBerry was able to hold its own— a strong operating system, stable, reliable—all the works. With the highly anticipated BlackBerry 6 OS debuting with the Torch, BlackBerry users can keep up with the competition—right?

The BlackBerry Torch does have all new features—upgraded camera, proper touch screen, security features, built-in GPS, universal search, and perhaps most favored by IT — the administrative control available. But is this enough to keep up with personal and work demands?

We found that for our users, the BlackBerry as a smart device is not cutting it. The app development has been slow for the BlackBerry OS, and the functionality of the apps are not up to par. If 14% (and growing) of our users need a second device, usually an iPad or iPhone, to maintain the quick pace of the workday, the Torch will not salvage RIM as a business-friendly product.

If 2011 is the year of the enterprise app, then this may be the beginning of the end for RIM. The BlackBerry has not made substantial enough strides to maintain functionality with all of the “super apps.” Salesforce already has 20,000 companies that have embraced their new Chatter mobile app, and it is no surprise that more than 50% of the workforce is using mobile devices as their new desktop. With more companies shifting towards app development, including FirstRain, maybe there is a reason that so many of our users who utilized BlackBerry’s also needed a supplemental device.

It is also quite hard for the BlackBerry OS to compete against the prominently featured “fun” iOS system. The iPhone is becoming so deeply embedded in our business culture, that it is seen as a necessity and the new iPad 2 is going to continue Apple’s overwhelmingly dominant control of the tablet market. Businesses like Juniper and Good.com are thriving with more consumers bringing their mobile devices into work (that now need additional security). In October, Good Technology released their first quarterly data report— illustrating how the rapid adoption of iOS is revolutionizing enterprise mobility and how they are benefiting from the move away from the Blackberry.

Whether this means more good news for Apple’s iOS and Google’s Android, or a meek future for RIM, one can’t be sure—but it is clear modern users will now demand competitive apps on their primary handheld device.

Check out the article in the March issue of CRM magazine talking about sales reps, and whether or not companies were willing to expand their sales teams. The article refers to a study by CSO insights in which they showed that companies who gave their reps access to sales intelligence (SI) had significantly shorter ramp-up periods. Given that 78% of the companies they surveyed said they are planning to add sales people this year – sales intelligence and productivity is a big issue.

“… the level of insights coming from a new generation of SI companies, such as FirstRain, InsideView, OneSource, and ZoomInfo, has expanded dramatically. Today, employing Web-crawling and other data-gathering methods, SI solutions constantly gather information about the marketplaces into which reps are selling, the competitive landscape, and details on prospect accounts and key stakeholders.

Think of it this way: Each sales rep has his own digital research assistant constantly to track key news and events in his territory. Let’s say a new executive gets hired in a prospect firm you are targeting, or a company reports an earnings surprise (good or bad), or a merger is announced in one of the industries on which you focus. The SI system immediately would notify you about any of those developments. Then that information could be appended to contact and opportunity records in the CRM system you are using to manage your pipeline.”

CRM magazine maintains that it’s worth it to invest in such intelligence; the knowledge that it provides is invaluable—and in many cases, unexpected. So if you’re looking to shorten the ramp-up period in expanding your sales team, check out our products!

Before the famous were famous—Oprah, Steven Spielberg, Bill Gates, and many others—they were interns. Everyone has to start somewhere, so why not begin your career where you are welcomed with open arms?

We have a small number of interns working at FirstRain right now and it’s interesting to look at not only the direct benefits for FirstRain, but also the indirect ones. Internships are powerful both for us (the company and the intern); it’s a great alignment of mutual interest.

The benefits to the intern are obvious. Experience drinking from the fire hose, training and rapid learning, the fun of working in a small dynamic company and, because it is small, the opportunity to work on a wide variety of different projects.

We benefit in some obvious ways – first and foremost that we get to interview someone on the job. Since the intern does not have job experience it’s hard to interview them on prior work experience (!) but by bringing them in and having them work on clear objectives we can review their performance and so make a more informed hiring decision.

But the non-obvious benefits are almost more interesting. Our new college graduates are fresh. They have new perspectives and challenge our assumptions – and the assumptions of how a job “should” be done. They are eager to learn and as all teachers know, teaching something causes you to think hard about what matters and really understand what you are teaching. There is also a fun energy you get into an organization when you have a group of professionals, often with 10-20 years of experience, mixed in with new graduates.

While Silicon Valley is coming back for people with experience, it’s still a hard place to find a job if you don’t have experience and this creates a Catch-22 for the intern. As one of our interns told me:

“For many of us recent college grads we have little or no real-world experience. This experimental period not only helps me decide what I would like to pursue in my career, but it also helps me because being able to reference an internship on a resume can make all the difference in a future employers decision. They can see if I have a strong work ethic, if I was smart on the job, and help me bridge from college to my new career. And I can check you out and network with your employees!”

So who knows whether I have a future Oprah or Bill Gates in my organization. But I do know that the added productivity, the energy and the opportunity to help the next generation of graduating students is a win-win for FirstRain – and it’s fun.