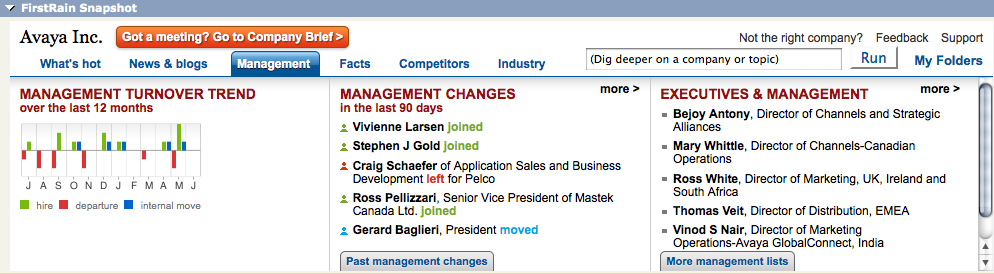

We’re making a snapshot of FirstRain intelligence available for free on Salesforce.com AppExchange today – so everyone can get access to intelligent business search results within their accounts, contacts, opportunities etc.

Today’s announcement is the new free applet – a snapshot – that shows What’s Hot for each account. What are the most important business topics impacting the customer? (for example breast cancer in the Pfizer example below) What are the most recent management changes? Who are the top competitors and what are the latest developments with them?

The snapshot is designed to help the sales person figure out what to say on a call or in a meeting – how to help the sales person make their conversation relevant to the customer and their business. Arming the sales person to talk about the changes impacting the customer’s business (and how he/she can help) rather than speed-and-feed a product.

Why should you care? Because unlike typical databases, FirstRain uses the web as the most dynamic, real time source of updates and intelligence for your sales campaigns. But unlike typical web search it extracts out the events that are impacting your customer… and de-junks, filters and ranks what’s hot for you, so you only see what matters. This means you can

- Prepare for a call instantly

- Understand your account in context

- See competitor events and top news and blogs

- Know the top hot industry topics impacting your accounts

- See key unannounced management changes

- Link into deeper intelligence and reports

=> Know what you should know — but never have the time to research

We have a number of customers who have already downloaded the applet and they are telling us that not only is the information immediately useful – but also downloading the applet was easy and it runs fast! Great to hear.

Here’s a link to the press release….. and here are some samples of how the applet works inside salesforce CRM. As you would expect – it also has many links into FirstRain so licensed users can easily jump into company briefs and deeper views of their customer’s business to use during meeting and campaign planning.

You can see a demo and screenshots – or download the app for yourself – on our page on AppExchange.

We’ve released a new version of FirstRain today which has a number of new features to provide our users even more depth on their companies and markets – even more quickly. You can read about all the features on today’s blog post on ignite.firstrain.com.

One of the very new, beta capabilities is Industry search and analytics. This is intended for marketing and sales people and analysts who need to quickly review an industry and what’s hot and changing in that industry — for example a salesperson coming up to speed on an industry because they have a new prospect, or analyst who wants an RSS feed of the important changes impacting the companies in an industry.

The industry brief generates top news, recent events, corporate governance indicators, industry health indicators, management turnover, top moving stocks, analyst comments etc. for the industry – all in one place – or sent to you through an RSS feed.

But more than that – it also shows you a market map for the industry – which are the top companies? What are the hot topics? What are the top business lines? All very useful to stay on top of an industry that is impacting your business. It’s up to the minute, automated and generated from the web.

Here are some images from the Internet Information Providers industry:

Guest post: Michael Prospero, Director of Research at FirstRain

As an analyst, one of the things I struggled with was the vast amount of information coming at me each day. A large part of my job was to read anything from or about my companies, competitor companies, industry bellwethers, thought leaders and of course the overall economy.

I set up Google alerts, but depending on the companies/stocks I entered I got a lot of junk both old and irrelevant. Also, there still isn’t a way to set up the types of sources you would like to read (e.g., no press releases or wire news) — the number of sources alerts covered is relatively small. The stated information from Google is that it watches more than 4,500 English-language news sites. and the number of alerts can become annoying if you have large portfolios of companies you’re tracking.

Additionally, I would have my stock ticker service up on my screen with the stock prices of my portfolios and this would provide an icon if there was news on a stock I had set up on the screen. A large part of my day was spent reading financial publications, checking news from the alerts on my companies, talking to customers and companies. When I had time in between those tasks, I spent my time working investment ideas.

As you read, you come up with ideas (idea generation), which leads you to search for other stories to either support or invalidate your theory. To find those stories, you would of course use Google search. Obviously, Google is very good at finding content, but because it’s most every source on the internet, you have to really hunt for something interesting and timely.

Oftentimes, you will find an article that is exactly what you were looking for in your search only to realize that it’s from 2006. Google search is comprehensive, but it’s tedious and extremely time consuming to dig through the clutter of totally irrelevant as well as non-business relevant content.

It’s been nearly three years since I was an analyst now and the one thing that has drastically changed is the number of blogs (and overall number sources on the internet) and their authoritativeness. In the beginning, the number of blogs was sparse and at best the authors of them were questionable. Now, we have blogs from extremely knowledgeable, connected, intelligent people and micro-blogging (e.g., Twitter) is yet the next step in the evolution of news.

So this leads to why I am at FirstRain: I believe if a system could have gathered all of the news that was business relevant, categorize it by company and topically, and allow me to personalize its delivery along with other preferences, it would have helped my process enormously. I could have spent more time on the phone and more time working on idea generation. Time spent on new ideas rather than time spent covering your butt is the way to create alpha.

We have a history of taking on whacky athletic challenges at FirstRain – both to get and stay fit and also to play together as a team.

Yesterday was no exception, although we were a small team this time. Three of us competed in the Splash and Dash in the Stevens Creek Reservoir in Cupertino CA. It was supposed to be a 1.2 mile swim and 3 mile run.

Well, it turned out a little different than we had expected. First off the water was really cold – which meant we were gasping for the first leg as we got accustomed to the temperature. And then the swim was not 1.2 miles – it was closer to 1.6-1.7 miles. We only knew this because it took me so much longer than last time I did it and so we asked around some of the more experienced competitors who estimated the distance for us based on their swim times.

It’s no wonder that at the end we didn’t run. We’d had enough. But we enjoyed it, we didn’t come last, and we are signed up for two more races this year!

Here we are before the race (we didn’t look as good afterwards!)

We’re holding two educational webinars in June on how to use strategic intelligence to accelerate revenue – both for marketing or for sales – and Pete Krainik posed a few questions to me for the CMO Club website last week. This is just a preview – if you’d like to join us for a live discussion on June 15th you can register here. And if you are a CMO you can join an interesting community of your peers at http://www.thecmoclub.com/.

Pete: What’s really available on the web today to help CMOs understand their market? Isn’t it just a lot of noise?

Penny: That’s a great question because I think many people do wonder if the web can help with strategic issues. It’s well understood how to look for PR coverage in the web, but the reality today is that the web is also the most current, up-to-date view of companies and markets – it’s more current than databases of company and market data because they just cannot stay up to date – and if you can detect the patterns in it the web holds a rich wealth of critical information about how companies and markets are changing.

Pete: What types of questions can be answered real time?

Penny: Some examples of the questions that can be answered real time from the web are:

- What are the new developments around a hot industry topic – and what companies are being impacted?

- What are the visible management changes at a company, whether or not they are announced?

- Who’s competing with who? (real time, not out of date relationships)

- What’s impacting my customers customer’s business – and how can it impact my strategy, my sales team and my revenue?

- What’s the context of a competitors announcement – and how is the broad market of influencers and bloggers reacting to it?

This type of strategic intelligence is absolutely present in the web, but the high levels of junk and duplication make it almost impossible to find quickly without a research engine designed to find and report on company, industry, hot topic and management information. But as a CMO you know you want your strategic marketing team and sales teams to have it, and not have to spend time looking for it.

Pete: What are the most frequently requested reports today?

Penny: The most common report is configured by CMOs for their specific intelligence space. You select the companies, related competitors, related industry topics and business topics that impact your market and a rich report on the latest developments is emailed to you, or you can subscribe in an RSS reader and see it on your phone, or push it into your internal company portals. In addition, FirstRain staff will always help CMOs do this if you need help and can add hot industry topics into the application if you are looking for a new narrow area of coverage.

The second type of report is a Company Brief. This is an auto-generated contextual report about a company – and includes the ecosystem (business lines, competitors, hot topics) around the company, recent management changes, lists of detected management and their bios, recent events for the company – and also for it’s competitors and it’s industry. Because this brief extracts material changes and events, rather than a stream of unfiltered news, it is a very efficient way to quickly see the market events that are impacting a company and it’s business. We see both marketing and sales people use it to prepare themselves, or their management, for customer meetings and calls.

Pete: So why can’t I do this with consumer tools like Google and Bing?

Penny: Google and Bing are truly excellent at extracting structure and getting you to the right answer for typical consumer questions – like shopping, travel, movie times or local store information. Even Yahoo Finance is good at getting you recent news from the most popular news sites. But what none of these tools do is provide you with similarly well structured answers for companies, industries and hot topics. These are concepts that are hard to capture in keywords, and where the most interesting information may not even mention a company name, but the right tool can detect that it a web article or blog post is about a topic impacting a company.

In addition to finding and filtering web information to generate useful intelligence, the other critical functionality for marketing is reporting suitable for strategic readers (like marketing, sales and executives). Time is money and the right reports, producing just the critical intelligence that is impacting a product line or market take users directly to critical strategic intelligence in seconds.

Pete: What is one piece of advice you would give CMOs in the club as they look to the web to help them understand their markets?

Penny: Focus on the efficiency of how your marketing and sales team use the web. The costs of the time it takes to use consumer tools are enormous but they are hidden and with the tools like Google (which is where everyone goes first today) the web is a huge time sink and distraction to your team. You need the strategic intelligence the web provides, but you need to get at it efficiently so I recommend you focus on the timeliness, quality and relevancy of the intelligence you pull out – and how long it takes your employees to retrieve it into their decision process.

Click here to register for upcoming CMO CLUB Roundtable Webinar with Penny on “How Do Top Marketing Teams Use Up-to-the-Minute Intelligence to Accelerate Revenue”: https://www1.gotomeeting.com/register/827670465

Click here for more information on FirstRain: http://ignite.firstrain.com/Marketing.php

We’ve formally announced the research engine to the press today – you can see the press release here.

I’ve been briefing editors for a few days now, and expect I will be through this week to. It’s the first time we’ve talked with the press about our new capability and the category “intelligent business search” – although our customers have been using it for several months now. We decided to wait to announce it until we were very confident of customer adoption and that the value we had planned to build was actually being experienced by our customers. And we’re there today!

Customers are telling us how much they like it:

- the helpfulness of the information and the time it saves sales in finding new opportunities and preparing for meetings

- the time it saves marketing in staying on top of everything happening in their market

- the ease of configuring for all our users – just what they want to see in the form they want to see it

- the freshness of the management change data, especially in comparison to traditional tools

- the freshness and breadth of intelligence because the web is the source, especially in comparison to the market intelligence services most users have access to today.

Bottom line – you can find higher quality intelligence in minutes instead of hours, and exactly what you need for your job. If you want to try it you can request a free trial here.

Google just entered the world of faceted search, following in Bing’s footsteps, and it’s a good move. John Battelle, wrote a strong piece on what they are doing “Google Steps Gingerly Toward Search As Application” and on why this is a necessary move for Google — to deliver search as an application rather than as purely simple keyword search. I couldn’t agree with him more.

It’s good that Google is taking this step for the consumer, and it’s a step professional search based applications have already taken – they just have to be a great deal higher productivity than consumer applications, because in the office time is money.

If you are a FirstRain user you know the benefits of this approach are to get you instantly to the businesses, ecosystem and analytics around your question to help you make a decision quickly. The wind power example Google used in it’s announcement is a good one to look at.

In the Google case here are the results you get:

The results include news and information from traditional media sources, nongovernmental organizations and online sources such as Wikipedia. The left-hand navigation offers the ability to refine results by time and by news, blogs, images, books and more. Related search terms such as solar power, hydropower and geothermal energy are also listed. It’s definitely a big improvement over early technologies.

But for a sales or marketing person what you need is fresh, business relevant results and navigation for the businesses in the industry and the ecosystem of companies engaged in the wind energy industry — wind power generation and distribution. Recent events, industry trends, people-related changes and management turnover are all detectable and attached to the search results. For example, users can identify planned commercial wind-turbine installations; track key components, parts and raw materials used in their construction; and identify suppliers poised to benefit from investments in wind power. Up-to-the minute reports can be delivered regularly via email or mobile phone so that users stay on top of new developments.

Here’s the contrasting screen shot – and in FirstRain you can navigate through management teams, competitors, hot topics and all the other elements of the ecosystem from here – which is what intelligent business search can give you.

There’s a great example of the impact of a rising trends on companies and regions on the stock research page of Fidelity.com today. You can get to this page here.

First look down on the right hand side – you can see the hot topics rising on the web. Not surprisingly Oil and Gas Ecological Issues is the hottest topic.

What you can now do is click through on the rising topic and see which companies are being impacted by it. Clearly BP and Transocean since they are being held accountable, but also the spill over (!) into positives for alternative energy sources like wind which will benefit companies like GE and Siemens.

Scrolling down on the Fidelity.com research page you can see a long list of interesting articles to read which give you a good in-depth view of which companies are impacted most by the tragedy.

Diversity is a strength – especially in management teams – but it can also lead to tension, misunderstandings and all the challenges that can appear when two people are very different and don’t “get” each other.

Years ago it was popular to hire expensive consultants – often called coaches – to work with executive teams and help them form tight bonds and appreciate one another but having been put through that type of coaching several times in my career at different companies I am now a great believer in the home grown use of personality based team building to develop an appreciation of the differences.

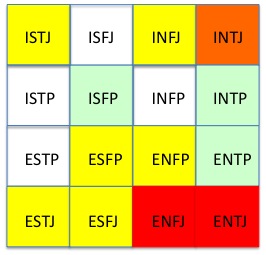

The method I advocate is going through Myers-Briggs Type testing as a team and sharing and talking about the results.

First step is everyone takes the test – online and together in a room – you can take the test here.

Next I explain (in lay terms) what the Myers-Briggs Type Indicators are – what they mean and what they indicate about each personality and how it influences and decision making. I’ll walk through the 4 dimensions and I use simple anecdotes to explain the differences – as I show here. (Each is a scale where you get a percentage along the scale to one end or the other as a measure of your personality type along that dimension.)

Note a healthy dose of humor and self depreciation at this stage breaks the ice and gets the team to relax.

E————-x————I

Extroverted vs. Introverted: what energizes you – being with people or being alone? To make a decision do you go and talk to other people or go for a walk? Are parties exciting or a bit of a chore?

S————-x————N

Sensing vs. Intuiting: Do you gather data and then make a decision – or do you intuitively make a decision and then use data to validate or invalidate your decision?

T————-x————F

Thinking vs. Feeling: Do you decide with your head or with your heart? Where are you in your body as you work through tough decisions.

J————-x————P

Judging vs Perceiving: This is a desire for structure – do you make lists, organize into spreadsheets, like operational process or do you prefer being open ended? Do you take a list to the grocery store or buy as the mood takes you? Do you plan your vacation down to the hour, or get in the car and just drive?

This is a layman’s view – Wikipedia has a much better description here.

And then – it’s time to share. I look for the extroverts in the team to start to talk – to share their type and talk about what it means and how it affects them in the team.

At this point I am at the white board and draw the chart (below) – and start putting names into the boxes so everyone can see where they fit – and how they are like, or unlike other people in the team. It’s really important at this point to make sure everyone understands there is no right or wrong, no one type is any better than any other – and that the strength lies in diversity. It’s much better in a team to have some P some J, some E some I , some N and some S. If you can leverage each other you can quite simply make better decisions because you can cover each others blind spots and biases.

I ran this process with our whole US team a month ago – and then our India management team last week. It was great fun both times. Lots of laughter (led by the Es) and some very insightful discussions about where the tension comes from. For example – a strong J can really annoy a strong P. J’s often state opinion as fact – they are putting structure on the opinion and testing the idea – but for a P this can seem arrogant and over constraining.

So how did my team come out? As you can see from this diagram we have a strong collection of leaders in the ENJ – they are extroverted, very intuitive and operational. Surprisingly this is not at all representative of the population at large. 63% of FR management are NJ, and yet only 7.8% of the population are NJ. So we have a very unusual concentration – and I think this is characteristic of the type of people who enjoy high growth, hurly burly opportunities where they can make decisions fast, based on intuition, and operationalize the execution.

If you are my competitor and you are reading this you may be able to figure out our inherent blind spot… except that I am not an NJ. My personality type is ESFJ. Very strong E (I like people a lot) and am a slight S, but I will challenge intuition by talking with customers and prospects. Knowing I am an ESFJ you can probably understand why I like to talk to customers every single day. That’s both where my energy comes from, and how I gather the input to steer the ship.

The end result of this exercise was very positive, especially within the executive team. We talked through some of the times when we don’t work as well together, and what triggers it – and it is personality related. Just reflecting together and reviewing tough conversations has now been very powerful to defuse the tension the next time it happened. I have the M-B chart on the wall in the office with everyone’s name on it and any of us can refer to it an any time to help understand a team mate – and the only rule is that we all have to remember to use it with a smile – it is just pop psychology after all.

We are announcing an exciting extension to our Capital IQ partnership today. We started this partnership almost 2 years ago – with this announcement – and over the last two years we have both grown our service to Capital IQ’s end clients and grown our relationship with the excellent team there. My guys really enjoy working with them and we’re delighted they want to include our service in their offering.

And so today we have announced that Capital IQ is now reselling FirstRain to their clients. We have embedded a FirstRain window into the Capital IQ platform that looks like this (with annotations):

and is a very similar integration to the approach we took with FactSet except that in addition to linking through to the search results of the research engine, Capital IQ has chosen to provide quick links directly into key pages like the management turnover page for a company – like this analytic on Pfizer:

This expansion of our relationship is good for both companies. It allows Capital IQ to add the rich experience of business intelligent search into their users research process, and it provides us with access to a new market. Capital IQ is widely used through the banking world, private equity and venture capital, as well as in many small investment firms.

As Randy Winn, executive managing director of Capital IQ said: “Over the past two years we have partnered with FirstRain to bring the most powerful business and financial intelligence to Capital IQ clients. FirstRain’s ability to identify, synthesize and rank critical business information that is scattered across the web provides a competitive advantage to our customers. We are pleased to extend our partnership and to be able to deliver the full range of FirstRain search and analytics to our end users.”