Diversity is a strength – especially in management teams – but it can also lead to tension, misunderstandings and all the challenges that can appear when two people are very different and don’t “get” each other.

Years ago it was popular to hire expensive consultants – often called coaches – to work with executive teams and help them form tight bonds and appreciate one another but having been put through that type of coaching several times in my career at different companies I am now a great believer in the home grown use of personality based team building to develop an appreciation of the differences.

The method I advocate is going through Myers-Briggs Type testing as a team and sharing and talking about the results.

First step is everyone takes the test – online and together in a room – you can take the test here.

Next I explain (in lay terms) what the Myers-Briggs Type Indicators are – what they mean and what they indicate about each personality and how it influences and decision making. I’ll walk through the 4 dimensions and I use simple anecdotes to explain the differences – as I show here. (Each is a scale where you get a percentage along the scale to one end or the other as a measure of your personality type along that dimension.)

Note a healthy dose of humor and self depreciation at this stage breaks the ice and gets the team to relax.

E————-x————I

Extroverted vs. Introverted: what energizes you – being with people or being alone? To make a decision do you go and talk to other people or go for a walk? Are parties exciting or a bit of a chore?

S————-x————N

Sensing vs. Intuiting: Do you gather data and then make a decision – or do you intuitively make a decision and then use data to validate or invalidate your decision?

T————-x————F

Thinking vs. Feeling: Do you decide with your head or with your heart? Where are you in your body as you work through tough decisions.

J————-x————P

Judging vs Perceiving: This is a desire for structure – do you make lists, organize into spreadsheets, like operational process or do you prefer being open ended? Do you take a list to the grocery store or buy as the mood takes you? Do you plan your vacation down to the hour, or get in the car and just drive?

This is a layman’s view – Wikipedia has a much better description here.

And then – it’s time to share. I look for the extroverts in the team to start to talk – to share their type and talk about what it means and how it affects them in the team.

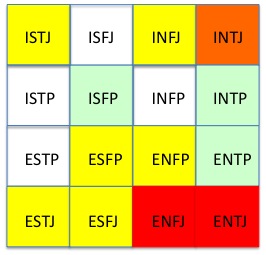

At this point I am at the white board and draw the chart (below) – and start putting names into the boxes so everyone can see where they fit – and how they are like, or unlike other people in the team. It’s really important at this point to make sure everyone understands there is no right or wrong, no one type is any better than any other – and that the strength lies in diversity. It’s much better in a team to have some P some J, some E some I , some N and some S. If you can leverage each other you can quite simply make better decisions because you can cover each others blind spots and biases.

I ran this process with our whole US team a month ago – and then our India management team last week. It was great fun both times. Lots of laughter (led by the Es) and some very insightful discussions about where the tension comes from. For example – a strong J can really annoy a strong P. J’s often state opinion as fact – they are putting structure on the opinion and testing the idea – but for a P this can seem arrogant and over constraining.

So how did my team come out? As you can see from this diagram we have a strong collection of leaders in the ENJ – they are extroverted, very intuitive and operational. Surprisingly this is not at all representative of the population at large. 63% of FR management are NJ, and yet only 7.8% of the population are NJ. So we have a very unusual concentration – and I think this is characteristic of the type of people who enjoy high growth, hurly burly opportunities where they can make decisions fast, based on intuition, and operationalize the execution.

If you are my competitor and you are reading this you may be able to figure out our inherent blind spot… except that I am not an NJ. My personality type is ESFJ. Very strong E (I like people a lot) and am a slight S, but I will challenge intuition by talking with customers and prospects. Knowing I am an ESFJ you can probably understand why I like to talk to customers every single day. That’s both where my energy comes from, and how I gather the input to steer the ship.

The end result of this exercise was very positive, especially within the executive team. We talked through some of the times when we don’t work as well together, and what triggers it – and it is personality related. Just reflecting together and reviewing tough conversations has now been very powerful to defuse the tension the next time it happened. I have the M-B chart on the wall in the office with everyone’s name on it and any of us can refer to it an any time to help understand a team mate – and the only rule is that we all have to remember to use it with a smile – it is just pop psychology after all.

I had the opportunity to speak at the Montgomery Technology conference in Santa Monica yesterday and, as often happens, the experience of presenting FirstRain every half hour for hours was exhilarating.

The conference is run by the specialist investment bank – designed for investors to talk with companies – and it attracted about 1,100 people this year. As a small company the reason to participate is to raise awareness of what we are doing and network with other CEOs, business development people from the Forture 1000 and, of course, talk with potential investors.

Since it is now so easy to quickly show the value of FirstRain I decided not to use any slides but just show it in every meeting. Having a light MacBook Air, wireless and fast fingers I had fun showing the product off in every discussion – in the general coffee area, in a suite, in a meeting room and eventually in my presentation. Now I did use a few slides when I was presenting to the room – but even then just a few and I quickly switched over to the product since seeing is believing with FirstRain.

And the result was a double edged sword. Everyone I spoke to was very impressed – “that’s really impressive” always sounds good to a CEO – and every potential investor I spoke with wanted to understand our stage and whether we were a good fit for them to invest in based on their approach (they were mostly PE or late stage VCs). And I had to disappoint every one. We closed a round of financing 2 weeks ago for $7.2M and so we are not in a position to take additional investment now.

So I took another path to bring them value. Almost everyone I met with is currently a Capital IQ user and so I showed them how to use FirstRain for their research and advised them to just call their Capital IQ sales person and ask for FirstRain through them since they are now one of our reseller partners. It was such fun to be selling, hand-to-hand selling. I love it! And I am glad to say I made a couple of connections with potential partners too.

We’ve been hearing from an increasing number of customers and prospects that they are not only trying to reduce their budget, but specifically trying to reduce their Bloomberg costs or replace Bloomberg altogether and I’m curious as to what’s really going on behind this.

Bloomberg has the premier platform today. It’s known for the deepest quality of data, having the best sales force, being the hardest to use, but also being the hardest to give up. The terminal has cachet. User’s have told us they feel as if their firm thinks less of them if they don’t have a Bloomberg terminal and it’s their link into their IM network. And yet for many of the users in our target market – we’re talking fundamental equity research guys – they only use a fraction of the functionality and in many cases they only use Bloomberg news.

The Bloomberg business model is very simple and consistent with a premier brand. One product, one non-negotiable fee of $1500-$1800 per month and for major accounts services are provided at no additional cost provided the total terminal fees are high enough. And they sell 2 year contracts and won’t cancel them even if the users have left. Makes good business sense.

So what’s a firm to do that has reduced the number of users and wants to dramatically reduce platform costs? What we are seeing is that as firm’s contracts with major high-end (i.e. expensive) vendors are rolling off they are looking at ways to swap the platforms and services out for less expensive ones. This risk/phenomenon is well captured in the Silicon Alley Insider’s The Bloomberg Terminal Stands On The Precipice.

And what it means for FirstRain is we are in an astounding number of conversations now, either alone or with one of our partners, with customers who are looking to replace Bloomberg. Because of the simplicity, and yet rigidity, of the Bloomberg model they are looking to replace it with a less expensive solution, especially when the users are only using it for news, and we help our partners provide a very rich news platform by mining the web for alternative research.

That said, we are careful to be respectful of everyone and not get between two large players because in the end what we offer is different and complimentary to all the platforms today – it’s a sales balancing act!

We’re busy ramping up our partnership with FactSet now – and the FactSet team invited me to talk on a webinar about how you can generate alpha (that’s gains over and above the market for you non financial types) from information that is freely available on the web today.

It’s a fun talk – it’s not about FirstRain – it’s about the information on the internet and how to use it. You can watch it here if you are interested.

We’ve seen a distinct increase in client interest in Governance over the last couple of months – probably as a result of the increased market volatility and risk. Looking at the pick up from a high level, we’re seeing four topic areas being requested and expanded – and they are requested by pension funds, by hedge funds trying to comply with their investor’s requirements and by companies wanting to remain on top of the investment communities requirements for their industry. The four areas are:

Corporate Governance: executive compensation, shareholder rights, board independence, proxy fights, and anti-takeover measures / by-laws changes.

Market Regulation: rule proposals and disclosures from the SEC, FASB, FINRA, NASDAQ, Department of the Treasury (US), and Internal Market and Services Commission (EU).

Regulatory Comment: from pensions, trade groups, financial firms, subject corporations, large investors, hedge funds and university endowments.

Environmental and Social Responsibility (ESR): United Nations Principles for Responsible Investment (UNPRI), country- and market-level environmental, social and governance oversight standards, and ethical divestiture risks.

All four are areas where we build out many topics (precision filters to serve up only the most relevant documents), research sources and continuously enrich the subject matter we pick up as the categories change in public opinion.

In addition, with the dramatic changes and exits at the top of the US banks, and the presidential candidates apparent outrage at the “excesses of executive compensation”, there is a great deal of focus on this area. And since I chair one compensation committee (RMBS) and sit on another (JDSU) it’s an area I personally pay a lot of attention to. The pundits are of course piling on – Gerald McEntee ‘s “Fundamentally Wrong” and RiskMetrics Group’s post have views from senators, lawyers, and governance advocates. My favorite callout is from an un-named Washington attorney calling the bailout terms “good governance coming through the federal backdoor.”

We’ve already see prior scandals like Enron and WorldCom leading to Sarbanes-Oxley and its ramifications for company governance. It seems unlikely this time around, with much broader repercussions, that today’s events won’t drive an ever more aggressive regulatory agenda from governments and shareholders, whomever gets elected.

Guest author: Dave Frankel, VP Business Development

I am writing this post from my American Airlines flight over Rapid City, South Dakota right now – connected to the internet via GoGo wifi . While I am generally a creature of habit when I get on my flights to and from CA (which almost always includes catching up on sleep), this time I figured I would try something new to see if it would improve the experience. I must say – I am hooked. I’ve already updated my Facebook status, participated in an email thread pertaining to a partner meeting I have tomorrow, got up to date on football news, checked in with my family via instant messaging (interrupting homework time), AND learned everything I needed to know about the our in-flight movie “Son of Rambow”. Who knew life could be this good?

It is a nice respite from what has been going on in the industry over the past week and half. As I was explaining to our Silicon Valley colleagues (who agreed with Penny’s post last week about how the financial meltdown hasn’t quite registered yet in sunny CA), there has been a dark cloud hanging over NYC since Lehman went down. The market swings, the daily debates about the proposed bailout, the questions about how the institutional investment industry is going to rebound, and the opportunities opening up to research providers are all regular topics of conversation for us in FirstRain’s NY office and in the field.

The truth is, no one REALLY knows what is going to happen next to this industry. As one of our Board members pointed out yesterday, there is not a person alive on the buyside that has ever traded through a phenomenon remotely close to this. Brokerage relationships are quickly being shifted, the availability of broker produced research is now in question, and consolidation and increased regulation appears to be on the horizon for investment managers, especially hedge funds. What this means is anyone’s guess – pundits, hedge fund managers, and common folk alike. One point on which we all can agree however: the art of institutional investing is going to be IRREVOCABLY CHANGED when the dust settles.

Despite reports of surging ratings for CNBC, I am personally finding the most thought provoking insights and opinions coming from the following: 1) sources I have already previously vetted from the web, like the daily updates from my friend Keith McCullough at Research Edge, the Integrity Research blog, Paul Kedrosky or John Mauldin’s Outside the Box, 2) sources published on the web that are forwarded to me from people that I respect and trust like colleagues or friends, or 3) of course, stories from the deep web that I might not regularly follow but that I uncover throughout the day from FirstRain. As I sit here at 35,000 feet reflecting on this, I realize that I have not felt the need to pick up the WSJ once in the past few weeks, and I certainly cannot remember seeing anything new and provocative on broadcast news about the financial industry meltdown. And, dare I ask, has anyone come across any market moving sell side research on the topic in the past two weeks?

Back to my decision to connect to the web via in-flight wifi. I must say, having tried it, I can’t see myself going back to transcontinental flights without being connected. Sure, I had to alter a routine that was working for me (and I definitely didn’t catch any zzz’s), and I am not quite sure about how much the option will allow me to accomplish in the future, but I see that the change is coming whether or not I embrace it. It’s probably better to be figuring out how to make the technology work for me (maybe download Skype before the next trip) than to think it’s just going to be a passing fad.

Next time, however, someone remind me to pack another laptop battery – my computer died before I was able to finish this post. With new opportunities come new challenges I guess.

My team were prepping me for a talk I am giving at NYSSA next week, and gave me some great statistics on why it is now so important to incorporate the web into your research process. For anyone who needs to get up-to-date, relevant information on business topics, if you don’t have an application to make the web practical you’re missing significant information. In fact, based on our analysis of the web results database we run, 12% of the content is on alternative sources like blogs, trade journals, transcripts etc. but then, when you focus it on business topics and companies, clean it up, de-dupe it, age it (only look at new content) and remove irrelevant documents an astonishing 27% is from alternative sources.

That means if you don’t have an application like FirstRain, you are probably missing more than a quarter of the content that impacts your business. Wow.

12% of total web content is alternative

I posted on Greenlight Capital and David Einhorn’s shorting of Lehman months back – David has been shorting Lehman for a long time based on his team’s analysis of the risk underlying Lehman’s business. He did what he thought was right and stuck to his guns despite being attacked by Erin Callan -then CFO of Lehman – and being made a poster child of the short sellers by the New York Times in June of this year.

After writing and researching that post my interest was piqued and so I read David’s book “Fooling Some of the People All of the Time“. It’s a bit wonky but provides a thorough, and thoughtful look into the research that goes behind the great short calls. I’m not talking about rumor driven shorting, I’m talking about months of fundamental research to model out a company’s business and study the discrepancies between what management is saying (and the stock is valuing) vs. what is really happening in the financials and the market of the company.

Given our business is about enabling our users to use the web as a broad, deep research base I love to read about the value of fundamental research to a portfolio manager.

We’re in sales training all day today and Keith McCullough of Research Edge came to talk to the sales team about the “tectonic shift” that is happening in investment research today and why he loves our service.

He gave us two terrific concepts that apply to our role in the shift.

1. “the edge is in the question – what question you ask and when you ask it”. It’s no longer speed, it’s no longer whisper, it’s about having the rigorous research process that you ask the question at the right time. FirstRain in the process stimulates continuous, valuable questions.

2. “the internet is the disintermediator”. He thinks there is a generational change happening. Technology is dramatically changing the way people get information. Why did Obama beat the Clintons? (whatever your politics Obama took a new, tactical, technology driven approach). It’s Google vs. the ad agencies – the old style is “coming down” and whole industries are being rebuilt – and Wall St is one of them.

Very inspiring stuff for our sales people. Keith is one of the very high performers on the street – well known for his performance – so he has great credibility with my team. He told them they are selling a hot product, on the leading edge, creating a market as the industry goes through radical change – heady stuff.

We track topics for our clients – which means finding documents that match their interests – and one of the hot tech topics is “cloud computing”. We call ourselves a SaaS – software as a service – application.

I was interested to see a thought provoking blog post in my daily report today on the difference between cloud computing and SaaS, but like many blog posts it got me thinking but didn’t help me answer the question about how FirstRain fits.

The premise of the post is based on a Gartner report which says that the basic difference between the two is massive scalability. But that doesn’t make pragmatic sense to me. Where do you draw the line between scalable, and massively scalable and does it mean anything practical in today’s world of apps with hundreds to millions of users?

I think the difference may lie in security. KMWorld’s recent article “Cloud computing and the issue of privacy” concludes that the heart of the issue is where the customer’s data resides and how security is handled. On the one hand you have professional apps like Salesforce – and FirstRain – that use a SaaS business model (subscription), manage massively scalable data centers and store user confidential data on their systems, on the other you have the consumer apps.

Professional apps are paranoid about security – our customer’s data is incredibly sensitive (we store user’s portfolios of stocks and their investment themes – Salesforce stores the customer base and business pipeline) and so we have extensive processes to control the security of the data. Without it we would not deserve our customer’s trust.

In contrast, Facebook and Google are relatively speaking pretty loose about security. From the KMWorld article

“I’m a trusting soul, but I have worked in and around online systems for more than 30 years. I have sitting not 10 feet from me a person who can write a script and suck content from any system to which she can get or has access. Privacy just like security is only as good as its weakest link.”

I agree. I won’t let my team use Google desktop search – I have friends who won’t use Firefox – Facebook has stumbled several times already on privacy. The more you know about the weak links in security the more you know the public apps are not secure.

So I like security as the heart of the difference. Cloud computing implies a massively scalable off-site compute environment – I agree. But SaaS implies a professional app with all the attendant security and service that implies.