Time is the enemy for strategic sales teams.

You make money when you truly understand your customer’s business. And that means understanding your customer’s customer. What is driving their business, what are the trends that they lie awake at night about? When is the right time to call — and who?

But the time it takes to do this for large global accounts, or for a set of accounts across diverse market segments, is quite simply prohibitive and so sales people don’t do it.

I’ve worked with global teams covering accounts like IBM, BP, Toshiba, Cisco — it’s incredibly important that each member of the team understands what is happening to the market and end customers of each local division or business line that they are responsible for managing and that they bring that knowledge and understanding into the account strategy and coordinated campaigns.

Another example is one where we are currently working with a senior sales rep (at a very large software company) who has target accounts across a diverse set of industries — and his effectiveness is directly impacted by how quickly he can come up to speed on his customer’s businesses.

I was with a strategic sales manager at a large telecomm customer of ours on the East Coast last week discussing this very issue. He reinforced to me how important it is that his team can be relevant when they gets on the phone with their prospect or customer. It changes the whole dynamic of the conversation and makes the discussion about the customer’s business challenges and how you can help – not about what product you are hawking.

When you integrate a solution to this problem sales people can tie their productivity gains, and the deeper campaigns they can create, directly to revenue — and it is one of the popular ways our users leverage FirstRain.

We’re running two webinars in 2 weeks – one for marketing on June 15th and one for sales on June 17th. Each one is focused on how our successful “rainmaker” customers use FirstRain to sell more to their leading customers.

If you know more about your major accounts than anyone else, and if it takes you just a few minutes a day to have that knowledge, you can provide better service to your customer. You understand their business better than your competitor does. You spot opportunities to help them, and you are prepared for every conversation.

Our webinars will show techniques to use FirstRain to do this. Join us here.

We find and analyze management for our customers. It’s one of the most popular things we do. So we know that helping users get a better, richer picture of who matters in the companies and markets they care about is valuable intelligence.

Enter from stage left: Salesforce.com buys Jigsaw.com today.

Jigsaw has a mixed reputation – from Michael Arrington of Techcrunch originally calling them evil in 2006, and then in 2009 just calling them amoral – to the New York Times describing them as driven by users self interest. They’ve been growing, but not like LinkedIn; revenue has been doubling, but was it enough to go it alone? But whatever you may think about their business model, and your “friends” revealing your contact information into a central database, the net result is more than 1.2 million members and more than 22 million contacts.

Salesforce has positioned this as entering the $3B data services market – and creating “new opportunities” to partner more closely with other data providers like D&B, Hoovers and Lexis Nexis. But I think this is a classic misdirect. I agree with Michael Maoz – what’s really going on here is the convergence in the needs of CRM and the social process.

Users want dynamic, current data. They know that today the most up-to-date information is on the web. It’s in networks, it’s in blogs, it’s living in the thousands of phoenixes (or should that be the correct Latin phoenices?) rising from the ashes of the breakdown of traditional journalism. They don’t want to get data from databases built from manual processes and filings – they are simply always out of date.

And so for Salesforce, the ability to pick up a dynamic contact list and the continuously updating process behind it (since we have to assume LinkedIn was not for sale) is a way for them to bring that dynamism into their CRM platform and into their moves into social media. It’s a smart move. But I do wonder what the long term impact is for the traditional, static databases. I know at FirstRain we are replacing Factiva today because our intelligence is richer, fresher (and easier, but that’s another story) – will Salesforce end up competing with Hoovers et al?

Matt Brown from Forrester shared a very interested survey result with me:

Forrester surveyed 2,000 US information workers last year, aged 18 to 64, and broke them into two groups for the analysis: GenX and Y (18-43) and Boomers (44-64) . And one area of interest was information workers ability to find what they need at work.

In an analysis of their ability to find and trust information their results are almost identical. No difference based on age. Also, 65% of them trust information from inside their company (sad that less than 2/3 trust their own company’s information) and only 35% of them trust information they find on the internet (not so surprising given the amount of junk that’s out there, especially if you don’t have FirstRain to clean it up for you).

It’s encouraging that independent of age, at least between 18 and 64, there is no noticeable difference in people’s ability to find what they need at work. It means that the older demographic is not at a disadvantage even though desktop computing developed once they were already well into their careers.

Diversity is a strength – especially in management teams – but it can also lead to tension, misunderstandings and all the challenges that can appear when two people are very different and don’t “get” each other.

Years ago it was popular to hire expensive consultants – often called coaches – to work with executive teams and help them form tight bonds and appreciate one another but having been put through that type of coaching several times in my career at different companies I am now a great believer in the home grown use of personality based team building to develop an appreciation of the differences.

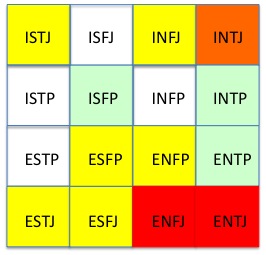

The method I advocate is going through Myers-Briggs Type testing as a team and sharing and talking about the results.

First step is everyone takes the test – online and together in a room – you can take the test here.

Next I explain (in lay terms) what the Myers-Briggs Type Indicators are – what they mean and what they indicate about each personality and how it influences and decision making. I’ll walk through the 4 dimensions and I use simple anecdotes to explain the differences – as I show here. (Each is a scale where you get a percentage along the scale to one end or the other as a measure of your personality type along that dimension.)

Note a healthy dose of humor and self depreciation at this stage breaks the ice and gets the team to relax.

E————-x————I

Extroverted vs. Introverted: what energizes you – being with people or being alone? To make a decision do you go and talk to other people or go for a walk? Are parties exciting or a bit of a chore?

S————-x————N

Sensing vs. Intuiting: Do you gather data and then make a decision – or do you intuitively make a decision and then use data to validate or invalidate your decision?

T————-x————F

Thinking vs. Feeling: Do you decide with your head or with your heart? Where are you in your body as you work through tough decisions.

J————-x————P

Judging vs Perceiving: This is a desire for structure – do you make lists, organize into spreadsheets, like operational process or do you prefer being open ended? Do you take a list to the grocery store or buy as the mood takes you? Do you plan your vacation down to the hour, or get in the car and just drive?

This is a layman’s view – Wikipedia has a much better description here.

And then – it’s time to share. I look for the extroverts in the team to start to talk – to share their type and talk about what it means and how it affects them in the team.

At this point I am at the white board and draw the chart (below) – and start putting names into the boxes so everyone can see where they fit – and how they are like, or unlike other people in the team. It’s really important at this point to make sure everyone understands there is no right or wrong, no one type is any better than any other – and that the strength lies in diversity. It’s much better in a team to have some P some J, some E some I , some N and some S. If you can leverage each other you can quite simply make better decisions because you can cover each others blind spots and biases.

I ran this process with our whole US team a month ago – and then our India management team last week. It was great fun both times. Lots of laughter (led by the Es) and some very insightful discussions about where the tension comes from. For example – a strong J can really annoy a strong P. J’s often state opinion as fact – they are putting structure on the opinion and testing the idea – but for a P this can seem arrogant and over constraining.

So how did my team come out? As you can see from this diagram we have a strong collection of leaders in the ENJ – they are extroverted, very intuitive and operational. Surprisingly this is not at all representative of the population at large. 63% of FR management are NJ, and yet only 7.8% of the population are NJ. So we have a very unusual concentration – and I think this is characteristic of the type of people who enjoy high growth, hurly burly opportunities where they can make decisions fast, based on intuition, and operationalize the execution.

If you are my competitor and you are reading this you may be able to figure out our inherent blind spot… except that I am not an NJ. My personality type is ESFJ. Very strong E (I like people a lot) and am a slight S, but I will challenge intuition by talking with customers and prospects. Knowing I am an ESFJ you can probably understand why I like to talk to customers every single day. That’s both where my energy comes from, and how I gather the input to steer the ship.

The end result of this exercise was very positive, especially within the executive team. We talked through some of the times when we don’t work as well together, and what triggers it – and it is personality related. Just reflecting together and reviewing tough conversations has now been very powerful to defuse the tension the next time it happened. I have the M-B chart on the wall in the office with everyone’s name on it and any of us can refer to it an any time to help understand a team mate – and the only rule is that we all have to remember to use it with a smile – it is just pop psychology after all.

I had the opportunity to speak at the Montgomery Technology conference in Santa Monica yesterday and, as often happens, the experience of presenting FirstRain every half hour for hours was exhilarating.

The conference is run by the specialist investment bank – designed for investors to talk with companies – and it attracted about 1,100 people this year. As a small company the reason to participate is to raise awareness of what we are doing and network with other CEOs, business development people from the Forture 1000 and, of course, talk with potential investors.

Since it is now so easy to quickly show the value of FirstRain I decided not to use any slides but just show it in every meeting. Having a light MacBook Air, wireless and fast fingers I had fun showing the product off in every discussion – in the general coffee area, in a suite, in a meeting room and eventually in my presentation. Now I did use a few slides when I was presenting to the room – but even then just a few and I quickly switched over to the product since seeing is believing with FirstRain.

And the result was a double edged sword. Everyone I spoke to was very impressed – “that’s really impressive” always sounds good to a CEO – and every potential investor I spoke with wanted to understand our stage and whether we were a good fit for them to invest in based on their approach (they were mostly PE or late stage VCs). And I had to disappoint every one. We closed a round of financing 2 weeks ago for $7.2M and so we are not in a position to take additional investment now.

So I took another path to bring them value. Almost everyone I met with is currently a Capital IQ user and so I showed them how to use FirstRain for their research and advised them to just call their Capital IQ sales person and ask for FirstRain through them since they are now one of our reseller partners. It was such fun to be selling, hand-to-hand selling. I love it! And I am glad to say I made a couple of connections with potential partners too.

We’ve been hearing from an increasing number of customers and prospects that they are not only trying to reduce their budget, but specifically trying to reduce their Bloomberg costs or replace Bloomberg altogether and I’m curious as to what’s really going on behind this.

Bloomberg has the premier platform today. It’s known for the deepest quality of data, having the best sales force, being the hardest to use, but also being the hardest to give up. The terminal has cachet. User’s have told us they feel as if their firm thinks less of them if they don’t have a Bloomberg terminal and it’s their link into their IM network. And yet for many of the users in our target market – we’re talking fundamental equity research guys – they only use a fraction of the functionality and in many cases they only use Bloomberg news.

The Bloomberg business model is very simple and consistent with a premier brand. One product, one non-negotiable fee of $1500-$1800 per month and for major accounts services are provided at no additional cost provided the total terminal fees are high enough. And they sell 2 year contracts and won’t cancel them even if the users have left. Makes good business sense.

So what’s a firm to do that has reduced the number of users and wants to dramatically reduce platform costs? What we are seeing is that as firm’s contracts with major high-end (i.e. expensive) vendors are rolling off they are looking at ways to swap the platforms and services out for less expensive ones. This risk/phenomenon is well captured in the Silicon Alley Insider’s The Bloomberg Terminal Stands On The Precipice.

And what it means for FirstRain is we are in an astounding number of conversations now, either alone or with one of our partners, with customers who are looking to replace Bloomberg. Because of the simplicity, and yet rigidity, of the Bloomberg model they are looking to replace it with a less expensive solution, especially when the users are only using it for news, and we help our partners provide a very rich news platform by mining the web for alternative research.

That said, we are careful to be respectful of everyone and not get between two large players because in the end what we offer is different and complimentary to all the platforms today – it’s a sales balancing act!

We’re busy ramping up our partnership with FactSet now – and the FactSet team invited me to talk on a webinar about how you can generate alpha (that’s gains over and above the market for you non financial types) from information that is freely available on the web today.

It’s a fun talk – it’s not about FirstRain – it’s about the information on the internet and how to use it. You can watch it here if you are interested.

A warning tremor rippled through the telco business last week – did you notice it? Apple announced that it will now allow iPhone users to use Internet calling services over cellular networks. Up until now you could use VoIP but only through Wi-Fi, i.e. not in most of the places you’d like make a phone call.

Last week “Apple … confirmed the change and said it applies to applications for the iPhone and the new iPad tablet device unveiled this week, some of which will come with 3G capabilities”.

You may remember that not long ago Apple blocked Google Voice which then triggered an FCC inquiry. Now “FCC Chairman Julius Genachowski on Thursday praised Apple’s latest decision”.

This is just the beginning of a disruption that will eat away at the core calling businesses of AT&T and it’s competitors. iPhone 3G apps from VoIP providers like fring, iCall and a soon to be upgraded Skype will start to eat away at call time and, while there are some technology challenges that are still annoying today, it’s only a matter of time.

Like many other technology trends it’s starting small but the disruption will be long term and profound. If your customers are in this space, or you invest in this space, there is a How To on our support blog you can use to get FirstRain to watch this space for you.

There is a fundamental change already underway in the world of books and it just accelerated yesterday. I don’t know whether to be happy to sad.

I have a Kindle. I love it, but I know I am a bit of a geek. To me, evidence that the world of books was shifting forever came when my mother (who is over 70 but how much over is private!) stated that she wanted a Kindle. And then yesterday Steve Jobs announced the iPad which has my kids friends all a’twitter (actually a’texting would be more accurate since Twitter is for old people) about ebooks now.

A couple of days ago I starting researching Amazon in FirstRain and, thinking about this phenomenon, went hunting for interesting content. As with most of our users, I tend to read certain sources and types of content more than others because of I believe they have better insight and are more reliable. FirstRain helps me sort through the noise easily by choosing the content type or sources I want to read. By selecting blogs only, I noticed a story from November titled Amazon (AMZN): “The best is still ahead”

“Amazon announced that its Kindle e-book reader is now its most popular selling item, both in units and in dollars. That led to a big acceleration in revenue growth (28%, the fastest in five quarters), while earnings leaped 67%.”

Expectations are that the holiday season was extremely successful for Amazon as online retailers, by most accounts, took share from brick-and-mortar retailers. The economic disruptions of the past two years have actually meant an acceleration in consumers’ adoption and use of the Internet as a retail channel.

Amazon’s earnings call is today so I’ll be looking for the transcript on FirstRain tonight (I can’t take the time to listen but I will speed read it) since this change to ebooks is such a ground shift in my way of consuming books – which I do voraciously.

But Amazon has bigger plans than my reading addiction. “Amazon is no longer content to be the world’s biggest e-tailer. Its new goal is to become the world’s leading retailer. Period.”

Aside from the other markets that Amazon has aspirations to dominate, I believe the company will own the market for books, both hard copy and e-books, in the next few years. Sadly the independent bookstore will all but disappear – although maybe there is room for one large single chain for the older readers who like to walk the isles, touch and smell (Yes, one of our engineers at FirstRain actually used the word smell) the books.

From looking into this in our system, it looks like the winner here will be Barnes & Noble (BKS), but I don’t believe the company will grow organically. Over the next few years, Barnes & Noble can prosper by becoming the brick and mortar bookstore choice and Amazon and Apple will garner the rest of the market share for books with both online hard copy sales and e-book sales.

Borders is definitely in decline. It will close an estimated 240 stores during the three months ending January 31, 2010 for a total of roughly 300 Waldenbooks stores over the past 13 months, or close to 70% of all Waldenbooks outlets! Retail analysts at Davidowitz & Associates give Borders Group a 50-50 chance of survival. (Added note – right after I posted this I saw the CEO has announced he is leaving and they are cutting 10% of their corporate staff).

From the Barnes & Noble website, as of October 2009, the company operates 775 stores. However, keep in mind the number of stores Barnes & Noble had at the end of 2004 was 820 so they are also down a bit. The Chicago Sun-Times reports that analysts expect an avalanche of bookstore closings this year. A new report by Grant Thornton report says 10,000 retail stores will have closed by the end of 2009. Of that number, 400 will be bookstores, which is a 500% increase in bookstore closings over 2008.

Within large department stores like WalMart and Target, the small numbers of book titles are probably safe and books will continue to be sold in niche markets like the point-of-sale newsstands in the airport where Hudson Booksellers seems to have most of the market – unless everyone who flys gets an iPad the way everyone who flys today has a cell phone .

Sadly used bookstores will probably disappear as well as no industry undermined by its greatest partisans survives for very long. Remember when CD sales plunged after music could be downloaded? Today, we can find any used book in the World for pennies on the dollar on Amazon and on other sites. “With the Internet, nothing is ever lost. That’s the good news, and that’s the bad news” says author Wendy Lesser in a New York Times piece by David Streitfeld (12/28/08).” But would this mean when I buy a first edition as a gift (as I did for a dear friend’s 50th birthday last year) I would not be able to hold it first? Hmmm… not sure about that.

What is certain is that the earthquake for books has hit, the after shocks and still coming – the iPad being the latest – and ten years from now I will probably only be buying the really hard to find history books I read in hard copy. Everything else will be coming from the cloud… another area Amazon wants to dominate but for another post.