The three most recent Signals on FirstRain tell an interesting story:

Combine this with a look at volume of content on the web around Apple. This is a chart of web content volume for Apple – here you can see that the discussion on Apple went quiet for a while, it then heated up around the Mobile computing discussion, but despite all the considerable chatter on the much-rumored Tablet on the web, the Quattro acquisition generated an even larger spike in web content.

All signs are that 2010 is the year that marks the major transition in Mobile computing platforms. The explosion of smart phones, the rapidly growing tablet choices, ebooks etc. all free consumers from their PCs and even from their Macs.

If the new Apple “Tablet” is as sexy a product as the iPhone was (and there is no reason to believe it won’t be) – their new move will allow them to grab an interesting piece of the mobile ad market and put Apple again in a commanding position.

This is probably why the Quattro acquisition is such a hot topic on FirstRain.

We’ve seen a distinct increase in client interest in Governance over the last couple of months – probably as a result of the increased market volatility and risk. Looking at the pick up from a high level, we’re seeing four topic areas being requested and expanded – and they are requested by pension funds, by hedge funds trying to comply with their investor’s requirements and by companies wanting to remain on top of the investment communities requirements for their industry. The four areas are:

Corporate Governance: executive compensation, shareholder rights, board independence, proxy fights, and anti-takeover measures / by-laws changes.

Market Regulation: rule proposals and disclosures from the SEC, FASB, FINRA, NASDAQ, Department of the Treasury (US), and Internal Market and Services Commission (EU).

Regulatory Comment: from pensions, trade groups, financial firms, subject corporations, large investors, hedge funds and university endowments.

Environmental and Social Responsibility (ESR): United Nations Principles for Responsible Investment (UNPRI), country- and market-level environmental, social and governance oversight standards, and ethical divestiture risks.

All four are areas where we build out many topics (precision filters to serve up only the most relevant documents), research sources and continuously enrich the subject matter we pick up as the categories change in public opinion.

In addition, with the dramatic changes and exits at the top of the US banks, and the presidential candidates apparent outrage at the “excesses of executive compensation”, there is a great deal of focus on this area. And since I chair one compensation committee (RMBS) and sit on another (JDSU) it’s an area I personally pay a lot of attention to. The pundits are of course piling on – Gerald McEntee ‘s “Fundamentally Wrong” and RiskMetrics Group’s post have views from senators, lawyers, and governance advocates. My favorite callout is from an un-named Washington attorney calling the bailout terms “good governance coming through the federal backdoor.”

We’ve already see prior scandals like Enron and WorldCom leading to Sarbanes-Oxley and its ramifications for company governance. It seems unlikely this time around, with much broader repercussions, that today’s events won’t drive an ever more aggressive regulatory agenda from governments and shareholders, whomever gets elected.

Guest author: Dave Frankel, VP Business Development

I am writing this post from my American Airlines flight over Rapid City, South Dakota right now – connected to the internet via GoGo wifi . While I am generally a creature of habit when I get on my flights to and from CA (which almost always includes catching up on sleep), this time I figured I would try something new to see if it would improve the experience. I must say – I am hooked. I’ve already updated my Facebook status, participated in an email thread pertaining to a partner meeting I have tomorrow, got up to date on football news, checked in with my family via instant messaging (interrupting homework time), AND learned everything I needed to know about the our in-flight movie “Son of Rambow”. Who knew life could be this good?

It is a nice respite from what has been going on in the industry over the past week and half. As I was explaining to our Silicon Valley colleagues (who agreed with Penny’s post last week about how the financial meltdown hasn’t quite registered yet in sunny CA), there has been a dark cloud hanging over NYC since Lehman went down. The market swings, the daily debates about the proposed bailout, the questions about how the institutional investment industry is going to rebound, and the opportunities opening up to research providers are all regular topics of conversation for us in FirstRain’s NY office and in the field.

The truth is, no one REALLY knows what is going to happen next to this industry. As one of our Board members pointed out yesterday, there is not a person alive on the buyside that has ever traded through a phenomenon remotely close to this. Brokerage relationships are quickly being shifted, the availability of broker produced research is now in question, and consolidation and increased regulation appears to be on the horizon for investment managers, especially hedge funds. What this means is anyone’s guess – pundits, hedge fund managers, and common folk alike. One point on which we all can agree however: the art of institutional investing is going to be IRREVOCABLY CHANGED when the dust settles.

Despite reports of surging ratings for CNBC, I am personally finding the most thought provoking insights and opinions coming from the following: 1) sources I have already previously vetted from the web, like the daily updates from my friend Keith McCullough at Research Edge, the Integrity Research blog, Paul Kedrosky or John Mauldin’s Outside the Box, 2) sources published on the web that are forwarded to me from people that I respect and trust like colleagues or friends, or 3) of course, stories from the deep web that I might not regularly follow but that I uncover throughout the day from FirstRain. As I sit here at 35,000 feet reflecting on this, I realize that I have not felt the need to pick up the WSJ once in the past few weeks, and I certainly cannot remember seeing anything new and provocative on broadcast news about the financial industry meltdown. And, dare I ask, has anyone come across any market moving sell side research on the topic in the past two weeks?

Back to my decision to connect to the web via in-flight wifi. I must say, having tried it, I can’t see myself going back to transcontinental flights without being connected. Sure, I had to alter a routine that was working for me (and I definitely didn’t catch any zzz’s), and I am not quite sure about how much the option will allow me to accomplish in the future, but I see that the change is coming whether or not I embrace it. It’s probably better to be figuring out how to make the technology work for me (maybe download Skype before the next trip) than to think it’s just going to be a passing fad.

Next time, however, someone remind me to pack another laptop battery – my computer died before I was able to finish this post. With new opportunities come new challenges I guess.

I sat on a panel today at NIRI (conference for IR) today in Fort Lauderdale and the topic was the changing role of the sell-side analyst. My fellow panelists represented the differing viewpoints of independent research – and a client – but the consensus was the same. The sell-side is going through radical change.

The problem started 30 years ago with commission deregulation – the day when how much a broker was paid to trade a share of stock was no longer regulated. As you can see from Rick Hanley’s chart here — the price of a trade has dropped continuously. Trading volume and investment banking were the two sources of funding for sell-side research — for the first the price per trade has plummeted, for the second Elliot Spitzer put up a wall between IB and research — and so the business model of traditional sell-side research within the big broker dealers is broken.

The net result is, unlike in the internet bubble when sell-side analysts were rock stars, now many of them have left and either gone into the buy-side or have set up their own research firms (or retired). Howard Penney from Research Edge talked about their new independent research model – clients just subscribe to research – no trading. Rick Hanley talked about his new service for management access (and how they partner with us) and Tom Digenan from UBS was the sole representative of the customer side. I was the lone techy (in a service intensive group) but rounded out the picture with the rapidly changing toolsets that are available.

In the end after much discussion and many questions from the IR professionals on how to use the sell-side it became clear that sell-side research is here to stay – but – and this is the but of change – it’s only one piece of the puzzle and is no longer the exclusive way to get to management – so IR has to learn to work with the other independent research and technology providers.

It was also clear the sell-side is not being careful enough of their company relationships. One of the IROs in the audience (who is IRO for a major cosmetics company) told me she is so frustrated with the sell-side she is ready to cut them out. Her complaint is that she can’t get the meetings she wants, with the investors she wants, through the sell-side because, at the 11th hour, they will swap out the institutions she wants her CEO and CFO to meet with and swap in their highest trading clients: the hedge funds.

There is clearly a role for unbiased management access now.

Your average search engine user has the patience of a toddler – they expect to leverage one or a few keywords to get the answer they are expecting and they’ll only try once or twice before giving up. If the results are bad, they’re not likely to try again – you’ve lost a user, or customer.

This is a hard problem to solve when the user is a senior professional looking for business information about a competitor – or the market trend behind a stock’s movement.

FirstRain is all about only the highest quality, high precision results for professional users and a critical piece of our system behind our results is our rich Metadata library. To put it simply, Metadata is data about data; for us, it’s the information architecture that captures what the documents in our system are about – and they can be about any number of concepts drawn from the thousands we’ve modeled. They can be literal (this is about Apple Computer) or they can be crossed by any number of building blocks (this is about layoffs at Motorola in Illinois).

The base layer of FirstRain is the categorization engine that identifies and tags what an article is about – a company, a market trend, an event. Since these tags determine what users see when doing research in our system (and remember – no patience with poor results), the rules that go into identifying them need to be spot on. For example, it’s necessary to ensure a new video game launch from a company like Electronic Arts is tagged appropriately, but a blog about how to reach new levels in one of their games is ignored. A single web document may have any number of tags reflecting the content in it. The article about Electronic Arts could also mention other relevant information about competitors and partners, as well as trends like video game sales; and it’s important to identify and tag each appropriate facet.

But just tagging the data to the right topics is only half the magic. Imagine what you can do if you can also analyze the frequencies of the Metadata. Keep in mind we have millions of documents in FirstRain, each containing numerous tags telling us what it’s about and where it’s from. Go back to the Electronic Arts example: FirstRain can identify the number of times EA is mentioned in conjunction with any related topic, such as new products, or any other company. We highlight spikes in these counts for our users and so show up emerging trends in number of mentions above or below their competition. These counts can give great insight into what a company is doing, or is about to do.

By treating the Metadata as a database in itself, and analyzing it for spikes and patterns we can identify emerging trends for users that they simply could not see from even the highest quality individual search results.

The global publishing giants have declared war on the new technology generation of content distributors – but they have lost sight of what consumers value and how they want to get to the value. It’s time to separate content creators from distributors. It’s time for a new business model which requires technology understanding and leadership to develop – and one that new generation search applications like Google News and Digg for the consumer, or FirstRain for the professional investor, can sign up for to get the right news to the right people at the right price for them.

Local publications like The Boston Globe are teetering on the edge of bankruptcy, others such as The Seattle Post-Intelligencer are moving exclusively online after 146 years in print and global giants like the Associated Press and Wall Street Journal are trying to fight back. But the reality is this is too little, too late and effectively going to war with your customers is a fatal strategy as Arianna Huffington posted a few days ago.

Face it – the consumers of news have changed – dramatically. We no longer read multiple news sources on the hope that we’ll find something interesting, most of the younger of us don’t take a daily physical newspaper and as services like Facebook, Digg and Twitter have shown, we expect the most interesting news to find us. It’s not that we believe news should be free – clearly there is discovery, research and production cost, but it should be allowed to roam freely across the many channels the web enables and still maintain proper attribution.

Our customers at FirstRain have shown us over the past three years that the authoritative news is no longer only found in the WSJ, FT et al. Instead it’s media like the DailyKos, Gizmodo, Consumerist, and In the Pipeline that are increasing the size of the news market pie and creating a huge demand for such obscure, on-the-edge news. In addition, the value of each piece of news varies by who’s reading it and what they plan to do with it. What a college student reads about Apple, Inc. on an obscure blog may be informative and help him plan on his next iPhone purchase, but to a portfolio manager at a Hedge Fund, that same information may be the bit of news he’s been looking for to insert into his model and make a multimillion-dollar trading decision. In both cases the news has value but the value, the search technology to find and rank the news and the delivery model is different in each case.

The critical issue still stands though – original investigative reporting is a public service that we, as a society, cannot do without. Journalists are our educators and our whistleblowers , our eyes and ears on the ground.

The news industry needs to find a recovery path through innovation and collaboration. As Scott Karp points out in his article in Publishing 2.0, this is a technology issue that is outside the comfort zone of traditional publishers. Here are three steps the AP and its 1,500 U.S. daily newspaper members and the Newspaper Association of America (NAA) need to consider in creating a viable business model for themselves and their customers:

* Protect the original content creators: Grant original content producers the opportunity to file as nonprofits under the same laws and protections offered to the Public broadcasting companies as supported by Senator Benjamin Cardin, of MD.

* Track the content: Work with aggregators like Google News, Yahoo, MSN, as well as NYT, WSJ, and the like on developing a new HTML standard that can be inserted into the original news articles to enable the tracking of news throughout its lifecycle.

* Develop a fee-sharing business model: Work with content distributors on an appropriate fee-sharing model to enable the distribution of originally published news through the various niche channels as diverse as Google News, Bloomberg, FirstRain, and even a locally-published community paper.

These options would give content producers multiple channels to sell through, and the ability to charge a real market price based on each distributor’s reach and depth, while at the same time providing an opportunity for smaller players writing original content to distribute their content through major channels for added revenue, outside of Google Adwords.

Then the AP and NAA would create a competitive environment and a generation of startups through which news is distributed to consumers and business professionals. And better yet, this would drive the separation of content creation from distribution – and set up a long term sustainable business model which is what the publishing industry so badly needs.

The commercial real estate crisis has been looming for months and it looks as though it’s being held back by a finger in the dam.

It starts with the low mall occupancy rates. We’re already seeing store closings like Circuit City and if you walk around any but the most successful malls you’ll see closed storefronts aplenty. This trend is now flowing into the firms which own the malls, for example the current poster child General Growth.

General Growth has a mountain of debt and would, under normal circumstances, have filed for bankruptcy by now. From the Wall Street Journal: “Creditors so far have been willing to let deadlines pass because they believe there is little to be gained and much to be lost through a bankruptcy. General Growth’s mall operations are stable and many bondholders hope for a greater recovery outside of bankruptcy court.

“This is really rare,” said Kevin Starke, an analyst at CRT Capital Group LLC, a research company that tracks distressed securities. “It is corporate-bond limbo like I’ve never seen before.”

So how long can this hold out last? How long until the finger (not forcing debtors into bankruptcy) is pulled out of the dam? There is definitely a difference of opinion on whether the problem is the business of the malls themselves, or just too much debt burden – read some point, counterpoint from the UK on this here.

And worse – what will the fallout be beyond commercial real estate? We have many clients using FirstRain in the REIT (Real Estate Investment Trust) research process and as I used FirstRain to understand more about the commercial real estate market my interest was caught by the connection between life insurance and commercial real estate outlined by the Jutia Group. This Crisis is Just Starting to Hit the Headlines where the author predicts the fall:

Take MetLife for example. MetLife has $36 billion worth of direct exposure to commercial real estate… and less than $19 billion of tangible equity. A 25% drop in the value of its commercial real estate holdings would cut tangible equity in half. That would crush the stock.

MetLife isn’t alone. I’ve got my eye on 13 North American insurance companies. And all of them will take large writedowns due to commercial real estate and variable annuity exposures. At least one of them will fail over the next year.

I wish I were wrong about this. And I have nothing against any of the companies involved. Many are well run and, until now, had decent track records as good investors.

But they simply can’t get out of the way. They’re like giant hotels sitting on a sunny tropical shore… with an enormous tsunami headed straight for them.

Right now, it’s time to go short on the biggest U.S. life insurance stocks.

Definitely a trend to watch.

There’s a turn in the U.S. employment market happening – there’s evidence that the number of layoff announcements and reported layoff events has started to drop. This does not mean the number of job losses will drop yet since announcements precede the actual elimination of jobs, but it is a leading indicator of the turn in the employment market.

Who is benefitting from a down stock market, millions of lay offs, and a depressing economy? It turns out there are pockets that are doing really well – like entertainment vendors, consumers in the market for discounted luxury goods, and global online auction websites, particularly China.

The reason is that the level of unemployment and the huge losses of personal wealth positively affect some businesses. For example, video games, consoles and accessories grew 29% in 2008 and the online game website Big Fish Games sales grew 70% — but even more than that the number of subscribers has jumped 110% since September (when the layoffs really started) and Big Fish has 30 job openings. Overall visitors to online game sites grew 30% – that’s what happens when people suddenly have a lot of time on their hands. You can read the WSJ’s take on it here.

But it’s not just gaming that’s growing. Sites that help the newly income-challenged sell their luxury goods at bargain basement prices – like Craigslist and eBay – have increased traffic. www.portero.com helps you auction off those gently used luxury goods (that your spouse told you not to buy in the first place) starting at 85% off. Of course if you want a jet, a yacht or even a Rolex you can now go to www.jameslist.com which caters to those of you looking for super high-end luxury goods.

Seriously though, the growth in auction sites is being seen globally — for example Analysys International reports that China’s C2C online retail market grew 140% in 2008 to approx $16.4 billion (U.S.) and is expected to reach $56.7 billion (U.S.) by 2011.

Looks like unemployment and the subsequent bargain hunting has a silver lining for the sites that help consumers amuse themselves and save money at the same time.

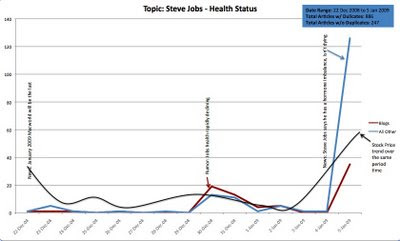

Here’s an interesting chart on the relationship between rumor, blogs, news and the stock price for Apple around Steve Job’s health . The period is Dec 22 thru Jan 5. The red line is blog volume on his ill health, the blue line is formal reported news on his health and the black curve is AAPL stock price.

Initially Apple announced that this would be the last MacWorld and that Steve would not be speaking. The stock dropped. Then Dec 30 the rumors start that Steve’s health is deteriorating. The blogs are ahead of the news and in higher volume than news, and the stock again dips. Then, when the news is official from Apple that Steve has a “hormone imbalance” (sadly no longer the whole story) the official news sites spike up, and blogs have a lower spike.

This is an example of the type of thing we see in FirstRain all the time. Blogs are ahead that something is up. They are often written by specialists with inside visibility into what’s changing – in this case people close to Apple. News follows and the stock moves on news, but that’s the same time everyone else gets the information. Most investors don’t yet have access to tools to help them sort out the junk in the blogosphere and filter for reliable sources. Queue FirstRain.