One of the more fascinating developments in our rapidly evolving financial markets is the shift that’s beginning to occur as the Baby Boom Generation—whose oldest members turn 65 this year—approaches and enters retirement. And while this event raises many societal challenges, ranging from the increased load on our health care system to the solvency of our social entitlement programs, it’s equally interesting to consider those folks who are recognizing the emerging needs and opportunities presented, and coming up with innovative ways to fill that need. And it’s a big need.

An interesting article last week from Canada’s Financial post articulates well the big demographics changes to come for countries like the U.S. And Canada, and the potential impact and opportunity for financial service providers:

“As you assess the stock holdings in your portfolio this fall, consider this: According to recent population projections, the proportion of seniors in Canada could nearly double in the next 25 years, while the proportion of children is expected to continue falling. If these demographic changes occur, it will have a major impact on the Canadian economy, which in turn will impact your investment portfolio…Financial service providers, especially wealth and asset management companies, also stand to benefit as an enormous amount of wealth is controlled by the Boomer generation. Institutions that cater to the specific needs of older clients will capitalize on this growing segment.”

One great example of a firm actively adapting to meet this opportunity is Fidelity Investments, who announced this week the launch of a greatly expanded set of market research and education tools focused specifically on helping Baby Boomers and others learn about and select fixed-income market investments. It’s a smart move, and we at FirstRain were very pleased that our technology was selected as one of the top tools available in the new Fidelity fixed income research suite. As their announcement notes, Fidelity users will be able to leverage a custom FirstRain implementation that provides, “trends analysis on the fixed income markets, so investors can see what fixed income topics are being discussed online and with what frequency. The content is categorized and investors can drill down into subcategories that change daily, depending on what is being discussed online.”

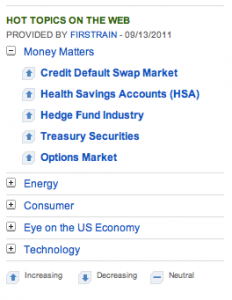

It’s a powerful tool that builds on the quite successful and popular FirstRain ‘Hot Topics on the Web’ tool that Fidelity users have already been using on the Fidelity.com Stock Research Center since 2009 (we’re told FirstRain hot topics are very popular on the page).

FirstRain ‘Hot Topics on the Web’ on Fidelity.com’s Stock Research Center

And the reason, we believe, it’s been so successful is because of the incredibly targeted, unique and interesting content we’re able to uncover from the business Web. Because, at our heart, we’re an analytics software company which applies powerful technology to uncover hard-to-find business content: our customers consistently tell us they find content on FirstRain that they wouldn’t otherwise find or would take them a great deal of advanced searching.

Fidelity has been a fantastic partner to work with over the last two years, and we’re very much looking forward to our expanded relationship and tackling these new challenges—and the opportunities they now present!