Last month’s announcement by Newssift (part of the Financial Times Group) of its meaning-based vertical search engine was an important new way to look at search for business professionals – you can quickly see how it’s different if you try it at www.newssift.com.

This morning, Newssift and FirstRain announced that FirstRain’s technology provides the business-relevant content: news, blogs, and other original, authoritative pieces of web content that Newssift consumes. We drive business content into the Newssift search application – here is the press release.

Why does this matter to Newssift? Well at the heart is the quest for quality of search results. If you’ve ever tried to use Google for business research you know how nearly impossible it is. You just get too many old and junky results back so you can’t sort the good from the bad – and so you can’t solve your research problem. In contrast, FirstRain has built its name providing highly relevant finance and market research information, extracted and analyzed from the web, to professional investors and corporate users. This matters because some of the smartest people in the world manage money. They run hedge funds, they manage billions of dollars of assets in mutual funds and pension funds – and they have a lower tolerance for junk or irrelevant data than any other group of users in the world. They have driven us to produce only the highest level of quality of research from the web.

As a result of our user’s demands, we’ve built considerable expertise in the quality of the content coming in which we are now making available to Newssift. The quality and classification of the sources, sorting out useful and authoritative blogs from junky promotional ones. Sorting out the highest quality journalism sources from countries all over the world. And now that content is flowing into Newssift so if you use Newssift you’re getting access to the first stage of the FirstRain advantage.

Newssift has led the way, and other media leaders now have a template. We read daily of publishers of every stripe struggling to build and retain their online audience. Whether it’s a technology trade journal, a leading voice of the blogosphere, an investing website, or a major metro newspaper, new tools are coming up to make the web useful for business research in the new generation of publishing that’s emerging. And Newssift won’t be the last.

Exciting times ahead.

The global publishing giants have declared war on the new technology generation of content distributors – but they have lost sight of what consumers value and how they want to get to the value. It’s time to separate content creators from distributors. It’s time for a new business model which requires technology understanding and leadership to develop – and one that new generation search applications like Google News and Digg for the consumer, or FirstRain for the professional investor, can sign up for to get the right news to the right people at the right price for them.

Local publications like The Boston Globe are teetering on the edge of bankruptcy, others such as The Seattle Post-Intelligencer are moving exclusively online after 146 years in print and global giants like the Associated Press and Wall Street Journal are trying to fight back. But the reality is this is too little, too late and effectively going to war with your customers is a fatal strategy as Arianna Huffington posted a few days ago.

Face it – the consumers of news have changed – dramatically. We no longer read multiple news sources on the hope that we’ll find something interesting, most of the younger of us don’t take a daily physical newspaper and as services like Facebook, Digg and Twitter have shown, we expect the most interesting news to find us. It’s not that we believe news should be free – clearly there is discovery, research and production cost, but it should be allowed to roam freely across the many channels the web enables and still maintain proper attribution.

Our customers at FirstRain have shown us over the past three years that the authoritative news is no longer only found in the WSJ, FT et al. Instead it’s media like the DailyKos, Gizmodo, Consumerist, and In the Pipeline that are increasing the size of the news market pie and creating a huge demand for such obscure, on-the-edge news. In addition, the value of each piece of news varies by who’s reading it and what they plan to do with it. What a college student reads about Apple, Inc. on an obscure blog may be informative and help him plan on his next iPhone purchase, but to a portfolio manager at a Hedge Fund, that same information may be the bit of news he’s been looking for to insert into his model and make a multimillion-dollar trading decision. In both cases the news has value but the value, the search technology to find and rank the news and the delivery model is different in each case.

The critical issue still stands though – original investigative reporting is a public service that we, as a society, cannot do without. Journalists are our educators and our whistleblowers , our eyes and ears on the ground.

The news industry needs to find a recovery path through innovation and collaboration. As Scott Karp points out in his article in Publishing 2.0, this is a technology issue that is outside the comfort zone of traditional publishers. Here are three steps the AP and its 1,500 U.S. daily newspaper members and the Newspaper Association of America (NAA) need to consider in creating a viable business model for themselves and their customers:

* Protect the original content creators: Grant original content producers the opportunity to file as nonprofits under the same laws and protections offered to the Public broadcasting companies as supported by Senator Benjamin Cardin, of MD.

* Track the content: Work with aggregators like Google News, Yahoo, MSN, as well as NYT, WSJ, and the like on developing a new HTML standard that can be inserted into the original news articles to enable the tracking of news throughout its lifecycle.

* Develop a fee-sharing business model: Work with content distributors on an appropriate fee-sharing model to enable the distribution of originally published news through the various niche channels as diverse as Google News, Bloomberg, FirstRain, and even a locally-published community paper.

These options would give content producers multiple channels to sell through, and the ability to charge a real market price based on each distributor’s reach and depth, while at the same time providing an opportunity for smaller players writing original content to distribute their content through major channels for added revenue, outside of Google Adwords.

Then the AP and NAA would create a competitive environment and a generation of startups through which news is distributed to consumers and business professionals. And better yet, this would drive the separation of content creation from distribution – and set up a long term sustainable business model which is what the publishing industry so badly needs.

The commercial real estate crisis has been looming for months and it looks as though it’s being held back by a finger in the dam.

It starts with the low mall occupancy rates. We’re already seeing store closings like Circuit City and if you walk around any but the most successful malls you’ll see closed storefronts aplenty. This trend is now flowing into the firms which own the malls, for example the current poster child General Growth.

General Growth has a mountain of debt and would, under normal circumstances, have filed for bankruptcy by now. From the Wall Street Journal: “Creditors so far have been willing to let deadlines pass because they believe there is little to be gained and much to be lost through a bankruptcy. General Growth’s mall operations are stable and many bondholders hope for a greater recovery outside of bankruptcy court.

“This is really rare,” said Kevin Starke, an analyst at CRT Capital Group LLC, a research company that tracks distressed securities. “It is corporate-bond limbo like I’ve never seen before.”

So how long can this hold out last? How long until the finger (not forcing debtors into bankruptcy) is pulled out of the dam? There is definitely a difference of opinion on whether the problem is the business of the malls themselves, or just too much debt burden – read some point, counterpoint from the UK on this here.

And worse – what will the fallout be beyond commercial real estate? We have many clients using FirstRain in the REIT (Real Estate Investment Trust) research process and as I used FirstRain to understand more about the commercial real estate market my interest was caught by the connection between life insurance and commercial real estate outlined by the Jutia Group. This Crisis is Just Starting to Hit the Headlines where the author predicts the fall:

Take MetLife for example. MetLife has $36 billion worth of direct exposure to commercial real estate… and less than $19 billion of tangible equity. A 25% drop in the value of its commercial real estate holdings would cut tangible equity in half. That would crush the stock.

MetLife isn’t alone. I’ve got my eye on 13 North American insurance companies. And all of them will take large writedowns due to commercial real estate and variable annuity exposures. At least one of them will fail over the next year.

I wish I were wrong about this. And I have nothing against any of the companies involved. Many are well run and, until now, had decent track records as good investors.

But they simply can’t get out of the way. They’re like giant hotels sitting on a sunny tropical shore… with an enormous tsunami headed straight for them.

Right now, it’s time to go short on the biggest U.S. life insurance stocks.

Definitely a trend to watch.

There’s a turn in the U.S. employment market happening – there’s evidence that the number of layoff announcements and reported layoff events has started to drop. This does not mean the number of job losses will drop yet since announcements precede the actual elimination of jobs, but it is a leading indicator of the turn in the employment market.

We’ve expanded our coverage today to include a number of topics our customers have been requesting to help them with their fixed income investing.

There are two major new areas covered

- Municipal bonds – this includes adding research on the bonds themselves, government infrastructure plans which are critical for modeling the risk on the bonds, municipal budget activity and job and employment trends – all tagged by state so you can just see research for the states you are interested in. In addition, we already have significant real estate coverage and so we’re tying that into the real estate impact on the tax base. More later – but we’ve introduced FirstRain content widgets onto http://ignite.firstrain.com/ for the first time and you can see samples of the type of data we’re finding in the Municipal Credit Crisis box.

- Corporate debt – this includes our usual coverage of companies and markets, but now extended to include the topics that would impact the risk of the bonds and convertible securities.

The second area is a new trend for many traditional equity investors. They wouldn’t have invested in corporate debt in the past but there is a new combination of events making it compelling. We have a number of hedge fund clients who look at the volatility of the equities markets and then compare them to the relative security – and significant rates of return like 15%+ available on some converts. Given that comparison – 15% from a senior convertible note or a crap shoot investing in the stock they understandably want to get research to help them decide on the risk profile of the convert. (If you are a Cadence employee/investor the Cadence converts are good examples of this trade off).

So if you have interest in the fixed income market and what original research is coming from the web check out the new FirstRain web site or read the press release here.

Who is benefitting from a down stock market, millions of lay offs, and a depressing economy? It turns out there are pockets that are doing really well – like entertainment vendors, consumers in the market for discounted luxury goods, and global online auction websites, particularly China.

The reason is that the level of unemployment and the huge losses of personal wealth positively affect some businesses. For example, video games, consoles and accessories grew 29% in 2008 and the online game website Big Fish Games sales grew 70% — but even more than that the number of subscribers has jumped 110% since September (when the layoffs really started) and Big Fish has 30 job openings. Overall visitors to online game sites grew 30% – that’s what happens when people suddenly have a lot of time on their hands. You can read the WSJ’s take on it here.

But it’s not just gaming that’s growing. Sites that help the newly income-challenged sell their luxury goods at bargain basement prices – like Craigslist and eBay – have increased traffic. www.portero.com helps you auction off those gently used luxury goods (that your spouse told you not to buy in the first place) starting at 85% off. Of course if you want a jet, a yacht or even a Rolex you can now go to www.jameslist.com which caters to those of you looking for super high-end luxury goods.

Seriously though, the growth in auction sites is being seen globally — for example Analysys International reports that China’s C2C online retail market grew 140% in 2008 to approx $16.4 billion (U.S.) and is expected to reach $56.7 billion (U.S.) by 2011.

Looks like unemployment and the subsequent bargain hunting has a silver lining for the sites that help consumers amuse themselves and save money at the same time.

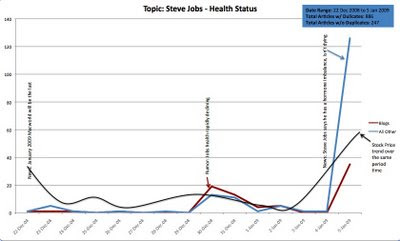

Here’s an interesting chart on the relationship between rumor, blogs, news and the stock price for Apple around Steve Job’s health . The period is Dec 22 thru Jan 5. The red line is blog volume on his ill health, the blue line is formal reported news on his health and the black curve is AAPL stock price.

Initially Apple announced that this would be the last MacWorld and that Steve would not be speaking. The stock dropped. Then Dec 30 the rumors start that Steve’s health is deteriorating. The blogs are ahead of the news and in higher volume than news, and the stock again dips. Then, when the news is official from Apple that Steve has a “hormone imbalance” (sadly no longer the whole story) the official news sites spike up, and blogs have a lower spike.

This is an example of the type of thing we see in FirstRain all the time. Blogs are ahead that something is up. They are often written by specialists with inside visibility into what’s changing – in this case people close to Apple. News follows and the stock moves on news, but that’s the same time everyone else gets the information. Most investors don’t yet have access to tools to help them sort out the junk in the blogosphere and filter for reliable sources. Queue FirstRain.

Here’s another example of management turnover signalling structural changes coming in a company. The WSJ reported on Saturday that Clear Channel, the largest radio and outdoor advertising company in the US, is planning to lay off 7% of its workforce, or 1500 people. It’s behind its competitors in doing a restructuring because of the 18 month battle to take the company private which finally failed in July 2008 – but clearly management knew major layoffs were coming and started leaving.

This chart shows the detectable management departures for just the last 6 months (we pick them up from the web even though they are not announced) and compares Clear Channel with its media competitors.

Satyam’s disastrous news of financial fraud two days ago – which sent the stock plummeting again – could have been seen in advance in the turnover at the top at the end of December. The company had struggled with two acquisitions last year – which we now learn were intended as a last ditch effort to fill the gap – but you can see here in the FirstRain management turnover chart of the last 90 days that 4 board members resigned in December, after very little top level turnover for years.

Board of directors mass turnover only usually happens in a private equity buyout where the board is replaced, otherwise mass turnover is a huge leading indicator that something is very wrong – as was clearly the case at Satyam.